A series of federal policy changes and rising healthcare costs set to take effect around 2026 are prompting financial planners and economists to warn that Why 2026 Could Change Retirement Plans Across the U.S. is no longer a theoretical question. The shifts — including new retirement-savings rules, potential tax increases, and long-term Social Security funding pressures — could affect millions of workers nearing retirement and reshape how Americans plan for old age.

Table of Contents

Retirement Plans Across the U.S.

| Key Fact | Detail |

|---|---|

| New 401(k) rules | Expanded catch-up contributions and Roth requirements for higher earners |

| Tax changes | Individual tax cuts scheduled to expire after 2025 |

| Social Security outlook | Trust fund projected to pay about 77% of benefits after depletion |

| Healthcare impact | Medical costs significantly reduce retirees’ effective income |

Congress could still change tax policy or Social Security rules before the early 2030s, but analysts say planning assumptions are already shifting. As Blanchett noted, “Retirement used to be about reaching a specific age. Increasingly, it’s about managing financial risks over time.”

A Convergence of Policy Changes

Economists say retirement planning rarely shifts because of a single law. Instead, multiple systems — taxation, benefits, and savings rules — are changing at once.

The SECURE 2.0 Act, passed by Congress in late 2022, gradually alters retirement savings rules through the mid-2020s. According to guidance from the Internal Revenue Service (IRS) and employer plan administrators, several provisions become especially significant by 2026.

“Many households built retirement strategies around tax deferral,” said Mark Iwry, a former U.S. Treasury retirement policy adviser and senior fellow at the Brookings Institution. “The new rules change when and how taxes are paid, which alters retirement timing decisions.”

Catch-Up Contributions Expand — But Become Taxed Differently

Workers aged 60 to 63 will be able to contribute larger “catch-up” amounts to 401(k) accounts. However, employees earning above $150,000 must place those additional contributions into Roth accounts, meaning taxes are paid upfront instead of at retirement.

Financial planners say the change may reduce short-term tax savings for higher-income workers, but could lower taxes later in life.

“It’s not a reduction in savings opportunity,” said Catherine Collinson, president of the nonprofit Transamerica Institute. “But it changes cash-flow planning, and that affects when people feel comfortable retiring.”

Automatic Enrollment Expands Retirement Participation

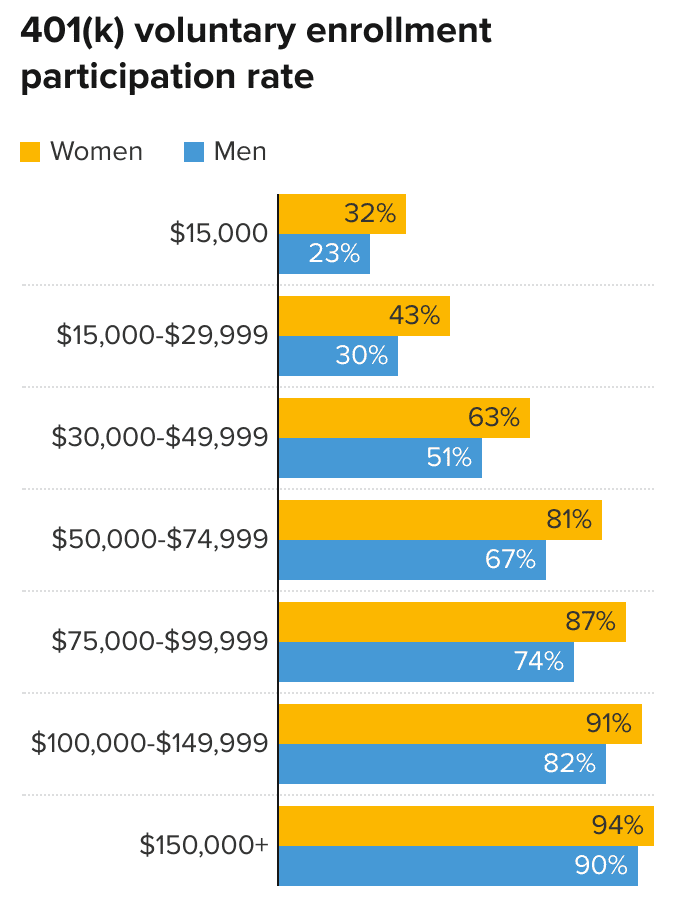

Starting in the mid-2020s, many newly created workplace retirement plans must automatically enroll eligible workers, with an opt-out option. Researchers say automatic enrollment historically increases participation rates.

The Employee Benefit Research Institute (EBRI) reports that participation rates often exceed 85% in plans using automatic enrollment, compared with about 60% in voluntary systems.

Greater participation could help younger workers accumulate savings earlier, though analysts note it may also widen differences between households with employer plans and those without access to retirement benefits.

Workers in part-time jobs, gig employment, and small businesses often lack access to employer retirement plans, meaning benefits of the policy will not be evenly distributed across the labor force.

Tax Policy Expiration Raises Uncertainty

Another major issue involves federal tax law. The individual provisions of the Tax Cuts and Jobs Act of 2017 are scheduled to expire after 2025 unless Congress extends them.

According to the nonpartisan Tax Policy Center, many taxpayers could move into higher tax brackets afterward. That would affect withdrawals from retirement accounts, which are taxed as ordinary income.

“Retirees plan around expected tax rates,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “When tax uncertainty rises, people tend to delay retirement or work part-time longer.”

The potential tax shift is especially important for Americans in their late 50s and early 60s, who must decide when to begin withdrawals from retirement savings.

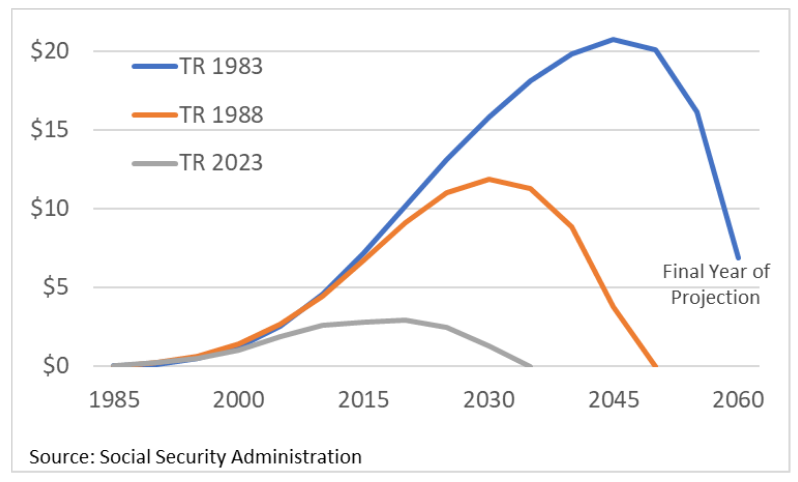

Social Security Funding Pressure

The Social Security Administration trustees report projects the retirement trust fund could be depleted in the early 2030s without policy changes. At that point, payroll taxes alone would cover about three-quarters of promised benefits.

The agency emphasizes current retirees will still receive benefits, but younger retirees could see reduced payments if Congress does not act.

“The system is not going bankrupt,” the trustees report states. “However, timely legislative action is needed to ensure full benefits.”

Experts say people planning retirement between 2026 and 2035 are the first cohort likely to adjust expectations based on the projections.

Rising Healthcare Costs Reduce Retirement Income

Healthcare costs are becoming a central factor in retirement planning. Medicare premiums and out-of-pocket medical expenses continue to rise faster than general inflation in many years.

Researchers studying retiree finances estimate healthcare can significantly reduce usable retirement income over time.

“Medical expenses are the most unpredictable cost retirees face,” said David Blanchett, managing director and head of retirement research at PGIM. “They’re also the hardest to plan for accurately.”

Higher-income retirees may also face Income-Related Monthly Adjustment Amount (IRMAA) surcharges on Medicare premiums, increasing monthly expenses.

Long-Term Care: The Hidden Expense

Financial planners say one of the least understood retirement risks is long-term care. Assisted living facilities and nursing homes can cost tens of thousands of dollars annually in many parts of the United States.

Unlike standard healthcare coverage, Medicare generally does not cover extended custodial care. As a result, retirees often rely on savings, family support, or Medicaid eligibility after assets decline.

Housing Costs and Inflation Complicate Planning

Retirement planning assumptions historically depended on stable housing costs after a mortgage was paid off. That assumption is weakening.

Property taxes, homeowners insurance premiums, and maintenance costs have increased sharply in several U.S. regions. At the same time, inflation during the early 2020s raised everyday expenses such as food, utilities, and transportation.

Economist Teresa Ghilarducci of The New School said many Americans underestimate inflation risk in retirement.

“Even moderate inflation can significantly erode fixed retirement income over 20 to 30 years,” she said.

Combined Impact on Retirement Age

Financial advisers say the combined effects — taxes, benefits, and healthcare — influence one critical decision: when Americans retire.

A growing share of older workers already remain employed longer. The U.S. Bureau of Labor Statistics (BLS) projects labor force participation among people aged 65 to 74 will continue rising over the next decade.

Some retirees may shift to part-time employment instead of full retirement, a trend researchers call “phased retirement.” Employers are increasingly offering flexible work arrangements to retain experienced employees in response to labor shortages.

Generational Differences in Retirement Expectations

Baby boomers, Generation X, and millennials face very different retirement outlooks.

Baby boomers are the last large generation with widespread access to employer pensions. Younger workers depend far more on individual savings accounts such as 401(k) plans and Individual Retirement Accounts (IRAs).

A survey by the Pew Research Center found younger Americans expect to work longer and rely less on Social Security than previous generations.

Many millennials also entered the workforce during economic downturns, including the 2008 financial crisis and the COVID-19 recession, reducing early savings accumulation.

International Comparison

The United States differs from many developed countries in how retirement is funded. In several European nations, public pensions replace a higher percentage of pre-retirement income.

In the U.S., Social Security replaces roughly 40% of average earnings for a typical worker, according to Social Security Administration estimates.

That makes private savings more important than in countries with broader public pension systems.

Behavioral Factors Affect Retirement Decisions

Financial planners note retirement planning is not purely mathematical. Psychology plays a significant role.

Research from the American Psychological Association suggests many workers underestimate life expectancy and overestimate how much they can safely withdraw from savings.

“There’s a gap between financial capability and financial behavior,” said behavioral economist Shlomo Benartzi, who helped design automatic enrollment retirement plans. “People know they should save more, but they delay action.”

Automatic enrollment provisions aim to address that behavioral tendency by making saving the default choice.

Why This Matters Now

Unlike previous policy changes, the effects converge within a narrow time window. Workers approaching retirement must make decisions about:

- when to claim Social Security

- how to withdraw retirement savings

- whether to delay retirement

“This is not a crisis year,” Munnell said. “It’s a planning year. People who adjust early will have more options.”

FAQs About Why 2026 Could Change Retirement Plans Across the U.S.

Will Social Security disappear in 2026?

No. The program will continue paying benefits. However, long-term funding projections suggest future benefit reductions without legislative reform.

Who is most affected?

Workers aged roughly 50 to 63 face the largest impact because they must adjust plans before retirement begins.

Does this mean Americans must retire later?

Not necessarily, but many households may choose to work longer to offset tax and healthcare costs.