Receive the Top Social Security Benefit: When it comes to retirement planning in the U.S., one question always finds its way to the kitchen table: “How high do my earnings need to be to get the maximum Social Security benefit?” It’s a fair question—and one that deserves a straight, no-fluff answer. Whether you’re building a six-figure career or pulling double shifts to stack your future, Social Security is still a cornerstone of retirement income for most Americans. So let’s dig deep into how it works, what the numbers look like, and what you can do now to set yourself up for the biggest possible monthly check later.

Table of Contents

Receive the Top Social Security Benefit

Let’s be real: Most folks won’t qualify for the maximum Social Security benefit. But that doesn’t mean you can’t do better than average. By understanding how the system works, tracking your earnings, and planning your retirement wisely, you can boost your monthly check, reduce surprises, and secure a bigger piece of what you’ve already earned. Social Security is not welfare—it’s a return on the taxes you’ve paid your whole working life. Treat it like the investment it is.

| Topic | Details (2026) |

|---|---|

| Maximum Taxable Earnings | $184,500/year |

| Maximum Monthly Benefit at Age 70 | $5,251/month |

| Minimum Years Required for Benefit | 10 years (40 credits) |

| Years Needed for Max Benefit | 35 years at/above earnings cap |

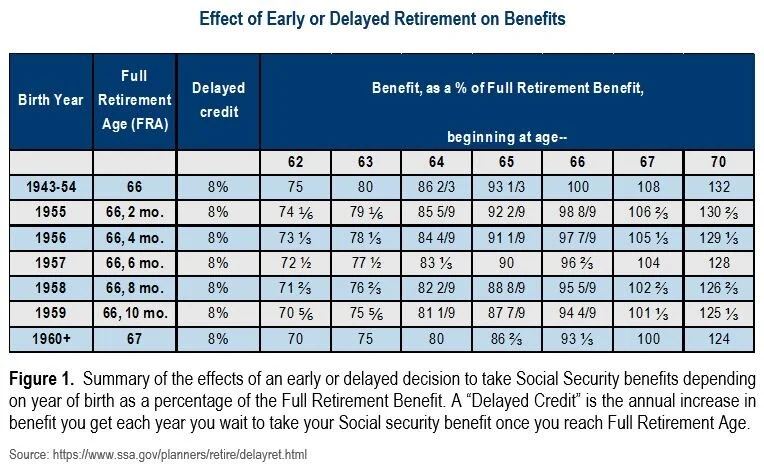

| Full Retirement Age (FRA) | 66 to 67, depending on birth year |

| Earliest Claiming Age | 62 (benefit is reduced) |

| Delayed Retirement Credit | ~8% more per year after FRA |

| Official Retirement Tools | SSA.gov Retirement Estimator |

Understanding How Social Security Really Works

Social Security isn’t some vague promise for the future—it’s your paycheck insurance for when you stop working. You contribute through payroll taxes during your working years, and in return, you get monthly benefits later.

But here’s the twist most folks don’t realize: how much you get depends on how much you earn AND when you claim.

The Social Security Administration (SSA) uses a formula based on your top 35 years of earnings, adjusted for inflation. If you worked less than 35 years, the SSA adds zeros to the calculation—which can seriously drag your average down.

Even if you earned a million dollars in a few years, you won’t get the max unless you consistently hit a certain threshold for a long stretch of time.

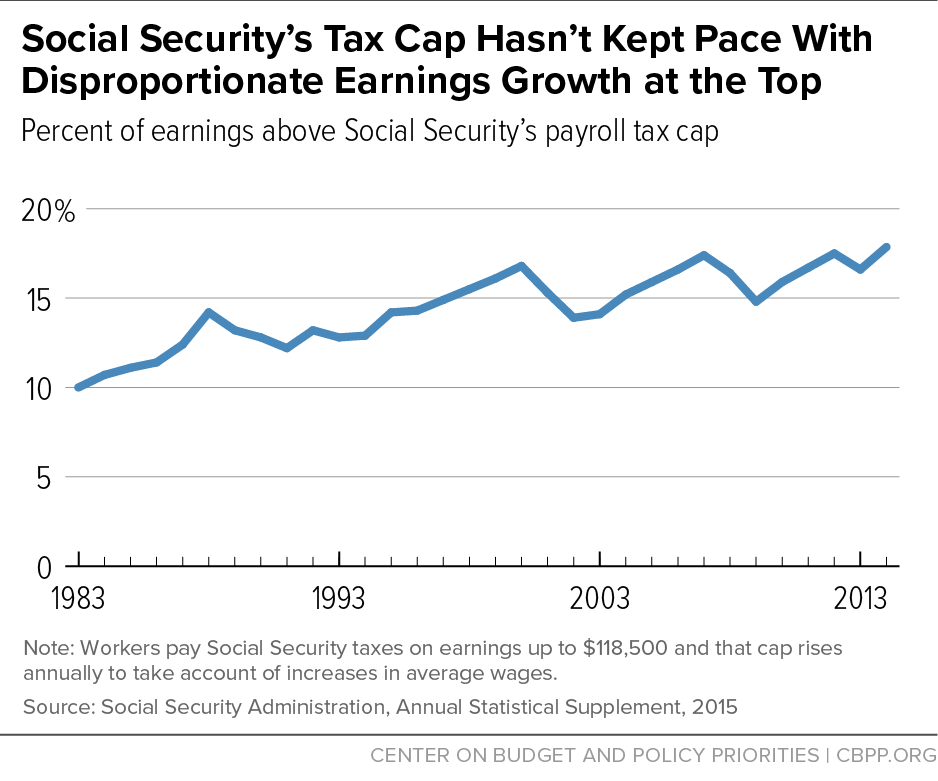

What Are “Maximum Taxable Earnings”?

Each year, there’s a limit to how much of your income is taxed for Social Security. This is called the “maximum taxable earnings” or Social Security wage base.

- In 2026, this cap is set at $184,500

- This means: only the first $184,500 of your income that year counts toward your future Social Security benefit

Even if you’re making $300K or more, anything above the cap doesn’t boost your future check. That’s why you’ll often hear financial advisors talk about this number as the “target income” for high earners.

How Much Is the Top Social Security Benefit?

The SSA adjusts its maximum payout every year based on changes in the wage base and inflation. Here’s what it looks like for 2026:

| Claiming Age | Maximum Monthly Benefit |

|---|---|

| 62 (earliest) | ~$2,969 |

| 67 (Full Retirement Age) | ~$4,207 |

| 70 (delayed max) | $5,251 |

You’ll only get that $5,251/month if:

- You earned at or above the taxable wage base for 35 years

- You delay collecting benefits until age 70

Real-World Example of Receive the Top Social Security Benefit

Let’s say we have two professionals—Lisa, a lawyer, and Ben, a public school teacher.

- Lisa earned over the Social Security wage base for 35 years and waited until age 70 to retire. She qualifies for the maximum benefit.

- Ben earned $60,000 per year, worked 35 years, and retired at 62. His monthly benefit is just under $2,000.

Both worked full careers, but the difference in income and timing made a significant impact.

Social Security vs. Private Retirement Plans

| Feature | Social Security | 401(k) / IRA |

|---|---|---|

| Guaranteed Lifetime Income | Yes | No |

| Inflation Protection | Yes (COLA) | No |

| Market Risk | None | High |

| Contributions | Fixed payroll taxes | Self-managed |

| Benefit Based On | Lifetime earnings | Personal contributions and investment returns |

Social Security is not a full retirement plan, but it’s a powerful supplement—especially because it provides income you can’t outlive.

The 35-Year Rule: Why It Matters

Here’s something you need to know: SSA calculates your benefit using your top 35 years of earnings. If you worked fewer than 35 years, they fill in the blanks with zeros.

Every zero year included in the average pulls your benefit down.

That’s why, if you’re close to retirement and don’t have 35 full years, it may be worth working just a few more to replace those zero years and boost your benefit.

Common Mistakes That Shrink Your Social Security Benefit

Even the smartest folks make mistakes when it comes to maximizing their benefit. Avoid these traps:

- Claiming Early Without Necessity

Claiming at age 62 reduces your benefit by up to 30% for life. - Failing to Check Your Earnings Record

Mistakes in your SSA earnings record? That could cost you big. - Leaving the Workforce Too Early

Even part-time work can help you replace lower-earning years. - Underreporting Self-Employed Income

Entrepreneurs who underreport earnings may save on taxes now but miss out on benefits later.

The Role of Inflation & COLA (Cost-of-Living Adjustments)

Social Security comes with a built-in boost each year known as the Cost-of-Living Adjustment (COLA). This helps benefits keep up with inflation—something 401(k)s and pensions usually don’t offer.

For example:

- 2023 COLA: 8.7%

- 2024 COLA: 3.2%

COLA increases are based on the Consumer Price Index (CPI-W). Even if you’ve already retired, your check continues to grow with inflation.

A Word on Self-Employed Professionals and Gig Workers

If you run your own business or do freelance work, you need to take extra care to ensure you’re building a strong Social Security record:

- Pay self-employment taxes using Schedule SE

- Report all income legally—even if it’s cash-based

- Use retirement planning tools to fill in gaps

Because you’re not getting W-2 wages, you’re 100% responsible for making sure the IRS and SSA see your full earnings.

How to Receive the Top Social Security Benefit: A Step-by-Step Guide

Step 1: Open Your MySSA Account

Check your official earnings record and projected benefits at ssa.gov/myaccount

Step 2: Work at Least 35 Years

Avoid those zero years by continuing to work—even part-time.

Step 3: Aim to Hit the Wage Base Each Year

If possible, earn at or above the taxable maximum.

Step 4: Delay Claiming Until Age 70

Each year past your Full Retirement Age (up to 70) adds about 8% to your monthly benefit.

Step 5: Coordinate With Your Spouse

If you’re married, strategic claiming (like spousal benefits or delaying one spouse’s claim) can maximize household income.

The Exact Strategy You Need to Secure the Maximum $5181 Social Security Benefit in 2026

New Social Security Bill Could Bring a $200 Monthly Boost in 2026