The story behind an elderly fraud case rarely begins with a dramatic theft. It usually starts quietly a missing payment, a bounced bill, or a confusing bank balance. In this recent elderly fraud case, a retired individual discovered that money saved over decades had disappeared through checks they never wrote.

For families, situations like this are deeply unsettling because the victim often followed the same routines for years. Writing checks for groceries, medicines, and household expenses felt safe and familiar. What makes an elderly fraud case particularly alarming is how quickly it grows. Seniors often rely on predictable habits, and criminals understand that. Once a fraudster gets access to a signature or banking details, multiple forged transactions can happen before anyone notices. This issue goes beyond money. It affects independence, dignity, and confidence. When a person who managed finances responsibly their entire life suddenly loses control over their savings, the emotional impact can be just as damaging as the financial loss.

An elderly fraud case involving forged checks shows how traditional banking habits are now being exploited. Criminals no longer need hacking skills or advanced technology. Sometimes all they need is a photograph of a check or access to a mailbox. Seniors who depend on paper payments become easy targets because they may not monitor accounts daily or use mobile banking alerts. In many situations the fraud continues for weeks before discovery. Banks, families, and caregivers are now realizing financial safety for seniors requires awareness, regular monitoring, and simple protective steps like secure storage and transaction notifications.

Table of Contents

Elderly Fraud Case Highlights Risks

| Key Detail | Information |

|---|---|

| Victim | Retired senior living independently |

| Crime Type | Forged check fraud |

| Method | Copied signature and unauthorized withdrawals |

| Discovery | Irregular bank balance noticed during statement review |

| Estimated Impact | Significant savings loss |

| Investigation | Bank fraud team and police involvement |

| Risk Factor | Checkbook access and limited monitoring |

| Current Status | Legal action and partial recovery efforts |

| Prevention Lesson | Monitor accounts and protect documents |

How The Scam Worked

- In this elderly fraud case, the criminal did not break into a home or hack a computer system. Instead, they obtained a legitimate check. It may have been taken from a mailbox, seen during a home repair visit, or recovered from documents thrown away without shredding.

- One check gave the fraudster everything required: the bank routing number, the account number, the address, and a clear example of the signature. With this information, they created several new checks. Rather than stealing a large amount at once, they withdrew smaller sums to avoid suspicion.

- The checks were deposited into different accounts and the money was withdrawn quickly. By the time the bank flagged unusual activity, the funds were already gone. Because many banks still rely partly on visual signature verification, a carefully copied signature can pass inspection. To the banking system, the payments looked normal.

Warning Signs That Were Missed

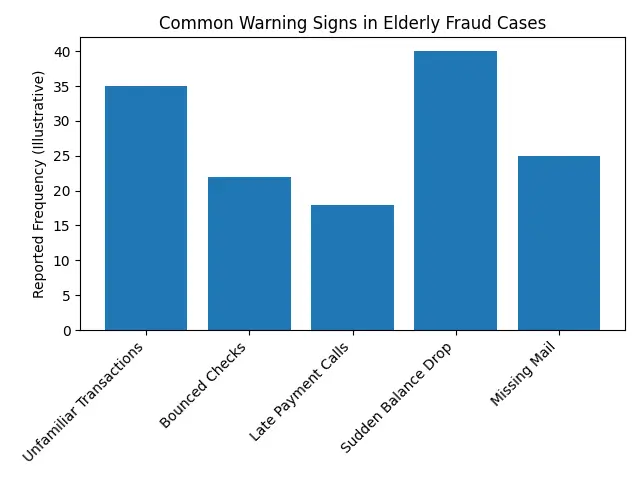

- An elderly fraud case often continues longer than expected because the warning signs appear small at first. In this situation, there were clues before the discovery, but they seemed harmless.

- Typical warning signs include unpaid bills despite payment, unfamiliar names on bank statements, a sudden drop in savings, and returned checks. Some seniors also receive calls from companies about late payments even though they believe they paid already.

- Many older adults review statements monthly instead of weekly. That delay gives criminals valuable time. A simple habit of checking account balances every few days could stop the fraud early. Families later realized the victim had also mentioned strangers near the mailbox, which may have been connected to mail theft.

The Investigation and Legal Response

- After the fraud was reported, the bank froze the account immediately and launched an investigation. The security team traced where the forged checks were deposited. ATM withdrawals, transaction timestamps, and surveillance cameras helped authorities identify suspects.

- Law enforcement treats an elderly fraud case seriously because it involves financial exploitation of a vulnerable person. Charges often include forgery, identity theft, and financial exploitation. Courts can impose stronger penalties when criminals knowingly target seniors.

- Banks also reviewed their security procedures. Many financial institutions now use behavioral monitoring systems. Instead of only checking signatures, software analyzes spending patterns. If a retired person who typically writes a few checks suddenly issues many payments to unfamiliar recipients, the system flags it.

Why Seniors Are Frequent Targets

- Criminals are selective. An elderly fraud case does not happen randomly. Seniors are targeted because their financial routines are predictable and easier to study.

- Retirement accounts often contain stable savings. Many seniors still use paper checks instead of online payments. They may trust visitors, caregivers, or callers more readily. Some are not comfortable using mobile banking applications or daily account monitoring tools.

- Isolation increases the risk. When a senior lives alone and does not regularly discuss finances with family members, fraud can continue unnoticed. Criminals depend on silence and delay. The longer the fraud remains hidden, the harder it becomes to recover funds.

Preventing Forged Check Fraud

- Most elderly fraud case situations can be prevented with small changes. Protection does not require complicated technology. It requires awareness and routine.

- Checkbooks should be stored in locked drawers rather than open desks. Outgoing mail containing checks should be dropped directly at the post office instead of placed in a home mailbox overnight. Financial papers should always be shredded before disposal.

- Bank alerts are extremely effective. A simple text notification for withdrawals can stop fraud the same day it starts. Seniors who prefer traditional banking can still benefit from alerts because they do not require computer knowledge.

- Whenever possible, automatic bill payments reduce risk. Fewer physical checks mean fewer opportunities for theft. Family members can assist seniors in setting up these protections without taking away independence.

The Role Of Banks And Caregivers

Banks now recognize the growing number of elderly fraud case reports and are adding protective features. Some accounts allow a trusted contact person to be notified if suspicious activity occurs. Others temporarily hold large withdrawals until they confirm with the account holder. Caregivers and relatives are equally important. They do not need full financial control. Simply reviewing statements together once a month can detect unusual transactions. Conversations about finances should be normal, not uncomfortable. Preventive discussions protect dignity rather than threaten it. Education also matters. Many seniors still believe physical checks are safer than digital payments. In reality, paper documents often contain more usable information for criminals than secure online systems.

Recovery Challenges

- Recovering stolen funds after an elderly fraud case is complicated. Banks sometimes reimburse victims, but only when the fraud is reported quickly. Delayed reporting can reduce protection because institutions assume account holders review statements regularly.

- Criminals typically withdraw cash soon after depositing forged checks. Even when suspects are arrested, full repayment may never occur. The legal process can take months or years.

- The emotional consequences are significant. Victims often feel embarrassed or blame themselves. Some lose confidence in managing money and become anxious about daily expenses. Families must reassure victims that fraud is not carelessness. It is deception designed to mislead careful people.

Lessons Learned

- This elderly fraud case demonstrates that traditional crimes still exist alongside modern cyber scams. While many people worry about email phishing or online hacking, check fraud remains common. Criminals target whatever method people trust most.

- The most important lesson is routine monitoring. Weekly account checks, bank alerts, and secure document storage dramatically reduce risk. Seniors should not abandon independence, but they should adopt protective habits.

- Awareness is powerful prevention. Families who discuss finances openly, banks that provide alerts, and seniors who review statements regularly create a strong defense. Financial security does not require fear. It requires attention and simple safeguards that protect a lifetime of savings.

FAQs on Elderly Fraud Case Highlights Risks

What is an elderly fraud case?

An elderly fraud case refers to financial exploitation where a senior citizen’s money is stolen through deception, such as forged checks, impersonation, or unauthorized transactions.

How do criminals steal checks?

They may take checks from mailboxes, photograph them, or retrieve discarded documents containing bank information and signatures.

Can the bank return stolen money?

Banks may refund losses if the fraud is reported quickly and the victim followed normal account monitoring practices.

How quickly should fraud be reported?

Immediately after noticing suspicious transactions. Quick reporting increases the chances of stopping withdrawals and recovering funds.