Viral posts circulating online claim governments are sending new relief money to citizens this winter. February 2026 Payments have become the subject of widespread confusion, but officials and economists say most deposits appearing in bank accounts are routine tax refunds or scheduled benefits, not emergency stimulus programs. The misunderstanding, amplified by social media, is affecting audiences well beyond the United States.

Table of Contents

February 2026 Payments

| Key Fact | Detail |

|---|---|

| No new nationwide stimulus | No federal relief program announced for February 2026 |

| Main deposits | Individual income-tax refunds |

| Other payments | Retirement and disability benefits on fixed monthly schedule |

Officials expect confusion to decline after the peak tax-refund processing period in March. Still, consumer agencies warn misinformation will likely recur in future filing seasons.

“Large government payment cycles always attract rumors,” a consumer-education officer said in a public advisory. “Verification, not viral posts, should guide financial decisions.”

Why the Rumors Spread Each February

Every year, the start of the U.S. tax season triggers millions of electronic transfers. As refunds begin arriving, screenshots of bank deposits quickly circulate online.

The Internal Revenue Service (IRS) warns that many taxpayers mistake these transfers for new aid programs. Consumer alerts published by the agency note a seasonal rise in misinformation and identity-theft scams tied to refund season.

Financial sociologists say timing is crucial. February overlaps three high-visibility financial events:

- refund processing,

- Social Security payments,

- political discussions about fiscal policy.

Because all involve government money, the public often interprets them as a single program.

Researchers studying stimulus rumors say online platforms amplify confusion by stripping posts of context. A bank screenshot without explanation spreads faster than an official statement.

What the Payments Actually Are

Tax Refunds, Not Stimulus

Most February 2026 Payments are refunds of taxes already paid.

Workers in the United States typically have income tax automatically withheld from their paychecks. When annual returns show they overpaid, the government returns the difference.

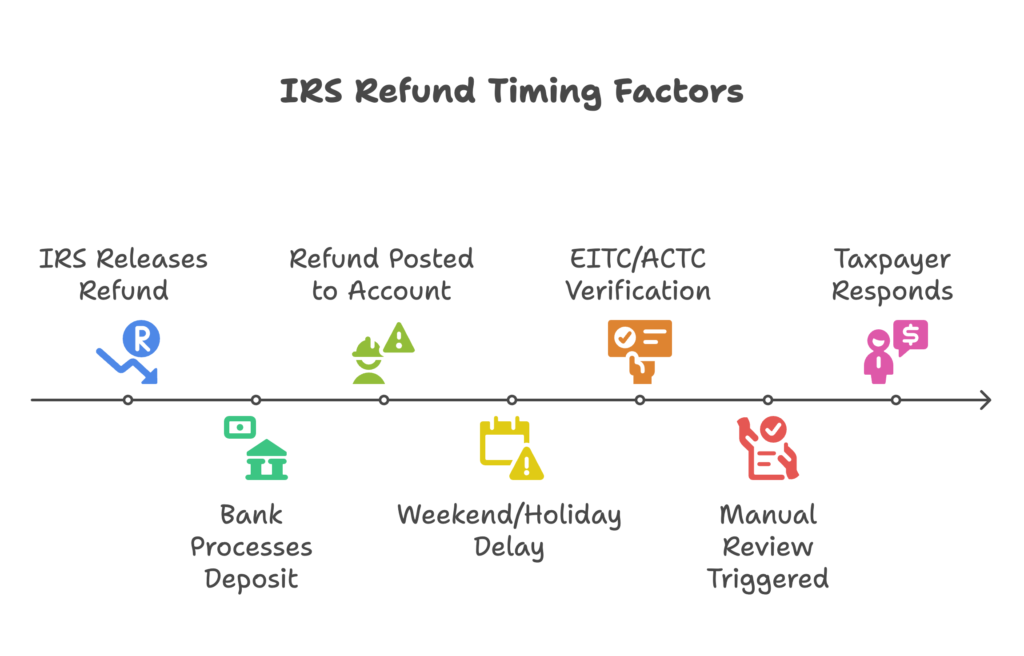

According to IRS guidance, electronic filers using direct deposit often receive refunds within approximately 21 days of acceptance.

A stimulus payment differs fundamentally. It is new money issued as economic relief, regardless of tax withholding. Refunds, by contrast, are repayments.

Tax professionals say the distinction explains much of the confusion. During the COVID-19 pandemic, many households received both refunds and relief payments at the same time, permanently linking the concepts in public perception.

Social Security and Disability Benefits

Another portion of February 2026 Payments consists of Social Security payments administered by the Social Security Administration (SSA).

These monthly transfers go to retirees, disabled workers, and survivors of deceased wage earners. The payment date depends on the recipient’s birth date and occurs on a predictable monthly schedule.

The SSA confirmed that benefits increased in 2026 through a cost-of-living adjustment tied to inflation. Congress established the formula decades ago to protect retirees’ purchasing power.

For recipients, the increase may appear as a new deposit amount. Online observers sometimes interpret the change as a new government program.

Proposed Policies Misinterpreted

Some online claims stem from proposed legislation. Lawmakers periodically discuss tax rebates, tariffs, or dividend-style payments. However, proposals discussed in political speeches are not actual payments unless approved by Congress and enacted into law.

Public finance experts say unfinished legislation frequently circulates as fact.

“Policy announcements are often interpreted as immediate programs,” said a fiscal policy researcher at a U.S. university economics institute. “In reality, legislation requires debate, voting, and administrative preparation before any payment can exist.”

Banking Mechanics: Why Deposits Look Mysterious

Part of the confusion arises from how electronic banking works.

When the U.S. Treasury sends a payment, banks receive it through the Automated Clearing House (ACH) network. The deposit description sometimes shows only a code, not a clear label.

Consumers may see:

- “TREAS 310”

- “IRS ACH”

- “SSA TREAS”

Without context, recipients often assume the deposit is unexpected aid.

Banking analysts note that electronic settlement often occurs overnight. A deposit appearing in the morning can seem sudden even though it was scheduled weeks earlier.

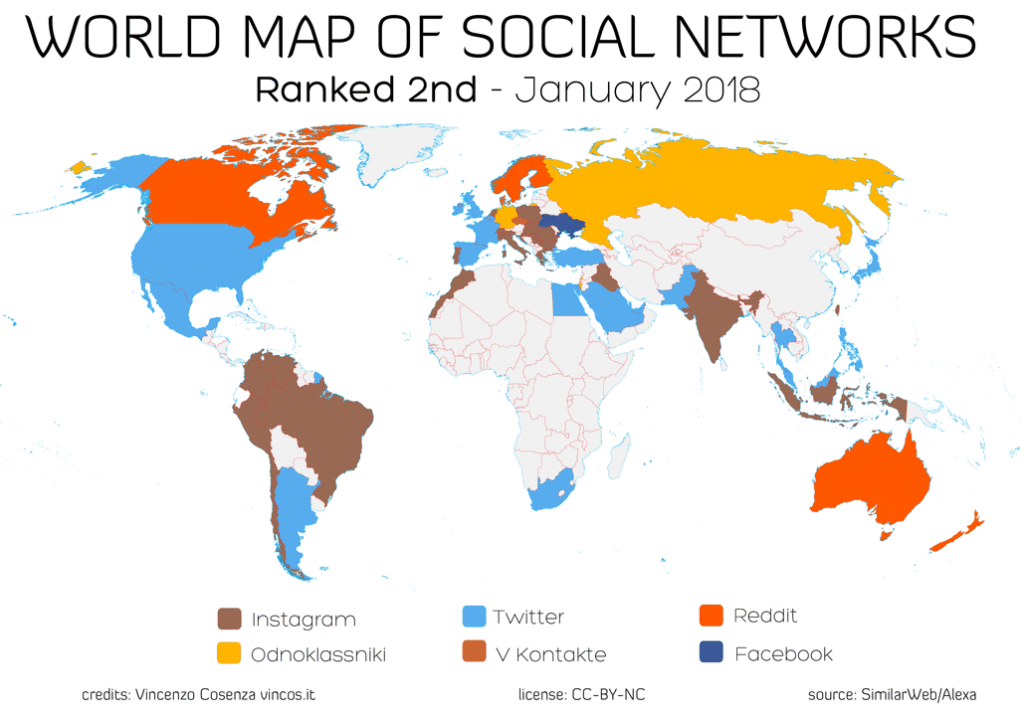

Why International Audiences Are Affected

Although February 2026 Payments relate primarily to U.S. programs, the rumors spread worldwide.

Digital misinformation researchers say social media algorithms do not account for national boundaries. A post created for American taxpayers reaches viewers in Asia, Africa, and Europe within hours.

In many countries, citizens also receive government subsidies or cash transfers, making the claim believable.

However, eligibility for U.S. payments generally requires a valid Social Security number and U.S. tax filing status.

Psychological Reasons People Believe the Claims

Behavioral economists say the rumors persist because they match expectations formed during the pandemic.

Between 2020 and 2021, emergency relief checks were widely distributed. Many households now associate direct deposits with crisis aid.

Psychologists call this the “availability effect.” When people experienced stimulus payments recently, they expect them again.

Additionally, financial stress increases belief in hopeful information. Studies of misinformation show economic anxiety makes individuals more likely to trust unverified financial news.

Scams and Consumer Warnings

Authorities say criminals exploit this confusion.

The Federal Trade Commission (FTC) and IRS report seasonal spikes in phishing emails and text messages posing as government agencies.

Typical scam tactics include:

- requests for bank account details,

- links to “claim your payment,”

- messages promising universal eligibility.

Officials emphasize that government agencies never ask for passwords, PIN numbers, or one-time verification codes through text messages.

Cybersecurity researchers say the goal is identity theft. Criminals use stolen information to file fraudulent tax returns and redirect refunds.

Comparing With Past Stimulus Programs

The last nationwide U.S. stimulus payments occurred during the COVID-19 emergency under federal relief legislation passed by Congress.

Those payments were designed to stabilize consumer spending during business shutdowns and job losses.

Unlike those emergency programs, February 2026 Payments come from routine fiscal operations — tax reconciliation and statutory benefits — not economic rescue policy.

Economists say understanding this difference matters because stimulus programs require extraordinary legal authority and budget allocations.

Broader Economic Context

The U.S. economy in 2026 operates under normal fiscal policy rather than emergency intervention. Government spending continues through existing programs such as Social Security, Medicare, unemployment insurance, and tax credits.

Policy analysts note that large-scale stimulus typically occurs only during recessions, financial crises, or natural disasters.

Current debates in Washington involve long-term budget deficits and interest rates rather than emergency relief spending.

How Citizens Can Verify Government Deposits

Financial experts recommend simple verification steps:

- Check official tax filing status online.

- Compare deposit codes with agency guidance.

- Contact the relevant government office directly.

- Avoid clicking links in unsolicited messages.

Banks also advise reviewing annual tax records before assuming a deposit is unexpected.

What To Do If You Receive a Suspicious Message

Consumer-protection agencies recommend:

- Do not reply to unknown senders.

- Do not download attachments.

- Report phishing attempts to official authorities.

In the United States, suspected scams can be reported to identity-theft reporting portals managed by federal agencies.

FAQs About February 2026 Payments

Are February 2026 Payments stimulus checks?

No. Most are tax refunds or routine Social Security payments.

Why do deposits appear suddenly?

Electronic transfers process automatically once approved.

Who qualifies?

Eligibility depends on tax filing status or benefit enrollment.

Can people outside the U.S. receive them?

Generally no, unless they meet U.S. residency and tax requirements.