Retirement planning can feel overwhelming, especially when you hear headlines about the maximum $5181 Social Security benefit in 2026. It sounds like a dream number. Naturally, many people wonder whether they can realistically qualify for the maximum $5181 Social Security benefit in 2026 or if it’s reserved for a small group of ultra-high earners.

The truth is, it’s possible, but it requires long-term strategy, consistent income, and smart timing. This guide breaks it down clearly, so you understand exactly what it takes and whether you’re on track. If your goal is to increase your retirement income, reduce reliance on savings, and maximize Social Security payouts, you need to understand how benefits are calculated. Social Security is not random. It follows a formula based on your earnings history, retirement age, and annual adjustments tied to inflation. Once you know the rules, you can make informed decisions that move you closer to the highest possible monthly check.

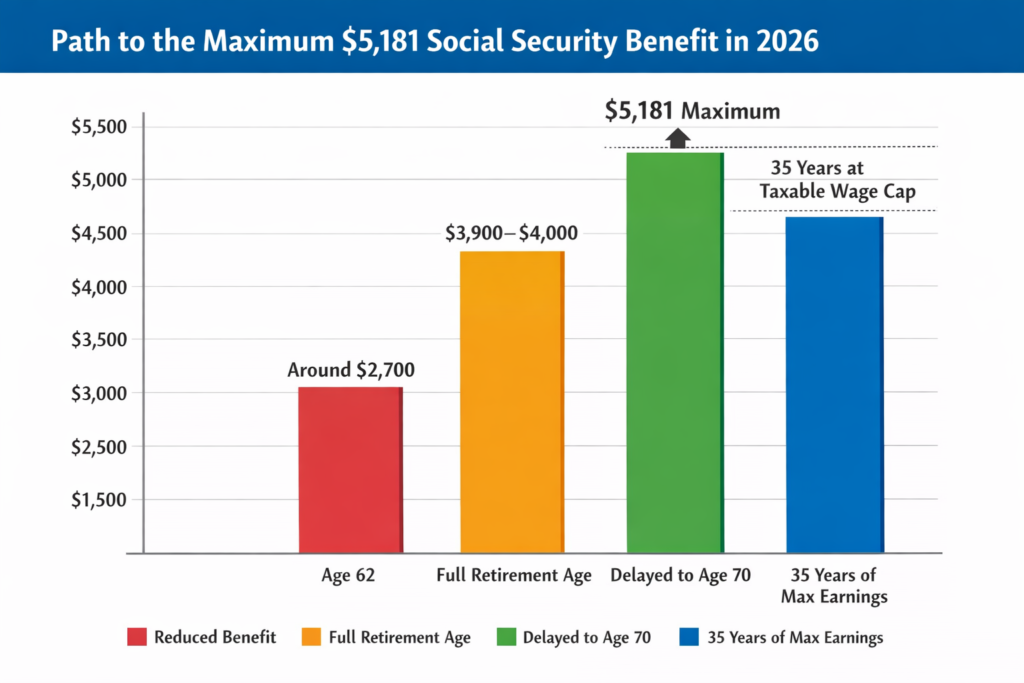

The maximum $5181 Social Security benefit in 2026 represents the highest projected monthly retirement payment available to someone who qualifies under strict conditions. Reaching the maximum $5181 Social Security benefit in 2026 requires earning the taxable maximum income for at least 35 years and delaying retirement benefits until age 70. This figure reflects expected cost of living adjustments and wage base increases for 2026. Most retirees will receive less because they either earn below the Social Security wage cap during their careers or claim benefits before full retirement age. Understanding how this maximum benefit is calculated is essential if you want to optimize your own Social Security strategy.

Table of Contents

Maximum $5181 Social Security Benefit in 2026

| Key Factor | Details for 2026 |

|---|---|

| Maximum Monthly Benefit at Age 70 | $5181 projected |

| Maximum at Full Retirement Age 67 | Approximately $3,900 to $4,000 |

| Maximum at Age 62 | Approximately $2,700 to $2,800 |

| Required Work History | 35 years |

| Earnings Requirement | Maximum taxable wage base each year |

| Delayed Retirement Credits | About 8 percent per year until age 70 |

| Annual COLA | Based on inflation |

Reaching the maximum $5181 Social Security benefit in 2026 requires long term planning and disciplined earning history. While most retirees will not hit that ceiling, understanding how the system works allows you to make smarter decisions today. Focus on earning consistently, working at least 35 years, delaying benefits if possible, and reviewing your earnings record regularly. Even if you do not reach the absolute maximum, these strategies can significantly improve your financial security in retirement.

How Social Security Calculates Your Benefit

- To understand how people reach the maximum $5181 Social Security benefit in 2026, you need to know how the system calculates payments. Social Security looks at your highest 35 years of earnings. Those earnings are adjusted for inflation and averaged to create your Average Indexed Monthly Earnings.

- From there, the government applies a formula to determine your Primary Insurance Amount. That is the benefit you receive at full retirement age, which is 67 for people retiring in 2026.

- If you worked fewer than 35 years, zeros are added to the calculation. That alone can significantly reduce your benefit. For anyone aiming at the maximum $5181 Social Security benefit in 2026, a full 35 year earnings record is non-negotiable.

Earn the Maximum Taxable Wage for 35 Years

The Social Security wage base is the income limit subject to payroll taxes. Only earnings up to that cap count toward your benefit. In recent years, the taxable maximum has been above $160,000 and continues to increase annually. To qualify for the maximum $5181 Social Security benefit in 2026, you must earn at or above the wage cap for at least 35 years. That means consistent high income over decades. Even a few years of lower earnings can reduce your final calculation. If your income rises later in your career, continuing to work can replace earlier lower earning years and increase your projected benefit.

Delay Claiming Until Age 70

- Timing is critical. You can claim Social Security as early as 62, but doing so permanently reduces your benefit by as much as 30 percent.

- Full retirement age is 67. If you claim at that age, you receive 100 percent of your calculated benefit. However, to reach the maximum $5181 Social Security benefit in 2026, you must delay until age 70.

- For every year you delay after full retirement age, your benefit increases by roughly 8 percent. These delayed retirement credits stop at age 70. There is no advantage to waiting longer.

- If you can afford to delay benefits, this strategy alone can dramatically increase your monthly retirement income.

Cost of Living Adjustments

Annual cost of living adjustments protects retirees from inflation. These increases are based on changes in the Consumer Price Index. The projected maximum $5181 Social Security benefit in 2026 includes expected cost of living increases leading into 2026. While COLA boosts everyone’s payments proportionally, it does not help you qualify for the maximum unless your base benefit is already high. Inflation trends in 2025 and 2026 will directly influence the final maximum number.

Work at Least 35 Years

Because Social Security averages your top 35 years, working fewer years hurts your calculation. If you have only 30 years of earnings, five zeros are added. That lowers your average. On the other hand, if you continue working past 35 years and earn more than earlier in your career, those higher income years can replace lower ones. Anyone serious about the maximum $5181 Social Security benefit in 2026 should review their earnings history carefully and consider extending their career if financially and physically possible.

Monitor Your Earnings Record

- Mistakes happen. Employers can report incorrect income. Name changes can cause errors. Self employment income may be misreported.

- Log into your Social Security account annually and verify your earnings. If you notice discrepancies, report them immediately. Even small errors compounded over decades can reduce your retirement benefit.

- Protecting your earnings record is one of the simplest ways to safeguard your path toward the maximum $5181 Social Security benefit in 2026.

Understand Spousal and Survivor Benefits

- While the maximum benefit applies to an individual worker, married couples can use coordinated claiming strategies to maximize household income.

- A lower earning spouse may claim up to 50 percent of the higher earner’s benefit at full retirement age. Survivor benefits may allow a widow or widower to receive the deceased spouse’s full benefit amount.

- Although this does not increase the individual maximum, it strengthens total retirement security.

Taxes and Medicare Considerations

- High Social Security income can come with tax implications. Depending on your combined income, up to 85 percent of your benefits may be taxable.

- Additionally, Medicare Part B premiums are deducted from Social Security payments. Higher earners may pay income related monthly adjustment amounts, which increase premiums.

- When estimating retirement income, consider your after tax benefit, not just the gross number.

Is the Maximum Benefit Realistic

- The maximum $5181 Social Security benefit in 2026 is achievable, but only for a small percentage of workers. It requires high lifetime earnings, steady employment, and delayed claiming.

- The average monthly Social Security benefit is significantly lower. For most Americans, the goal is not necessarily the maximum but optimizing benefits within their career reality.

- That said, even modest adjustments in retirement timing and work duration can increase your lifetime payout by tens of thousands of dollars.

FAQs on Maximum $5181 Social Security Benefit in 2026

1. Who qualifies for the maximum $5181 Social Security benefit in 2026

Workers who earn at or above the Social Security taxable wage base for 35 years and delay claiming until age 70 qualify for the maximum projected benefit.

2. Can I reach the maximum benefit if I retire at 67

No. To receive the highest possible payment, you must delay until age 70 to earn delayed retirement credits.

3. What happens if I worked fewer than 35 years

Social Security averages your top 35 years. Missing years count as zero income and lower your benefit.

4. Does inflation affect the maximum Social Security benefit

Yes. Annual cost of living adjustments increases benefits and can raise the projected maximum payment each year.