The New $6000 Senior Tax Deduction marks one of the most significant federal tax changes for older Americans in several years, offering additional relief to millions of retirees beginning with the 2025 tax year. Designed to lower taxable income for individuals aged 65 and older, the deduction can reduce federal tax bills for seniors who receive Social Security, pensions, or retirement account distributions. However, it does not alter the underlying rules governing Social Security taxation and remains temporary under current law.

Table of Contents

New $6000 Senior Tax Deduction Begins

| Key Fact | Details |

|---|---|

| Deduction Amount | $6,000 per eligible senior; $12,000 for qualifying married couples |

| Eligible Age | 65 or older by the end of the tax year |

| Effective Years | 2025 through 2028 |

| Impact on Social Security | May reduce taxable income but does not change taxation formula |

| Income Phase-Out | Begins at moderate income levels; eliminated at higher incomes |

As the deduction takes effect, millions of seniors will assess how it changes their tax obligations. Whether the New $6000 Senior Tax Deduction becomes a permanent feature of the tax code will likely depend on future budget negotiations and broader debates over retirement security, fiscal sustainability, and the role of tax policy in supporting aging populations.

What Is the New $6000 Senior Tax Deduction?

A Structural Change to Federal Tax Relief for Seniors

The New $6000 Senior Tax Deduction allows qualifying taxpayers aged 65 or older to deduct up to $6,000 from their taxable income each year. Married couples filing jointly may claim up to $12,000 if both spouses meet the age requirement.

Unlike tax credits, which directly reduce taxes owed, deductions lower the amount of income subject to taxation. As a result, the financial benefit varies depending on a taxpayer’s income level and marginal tax rate.

This deduction applies in addition to the standard deduction or itemized deductions, representing a layered approach to tax relief for seniors rather than a replacement of existing benefits.

Why Policymakers Created the Deduction

Rising Costs and Fixed Incomes

Lawmakers supporting the measure pointed to rising living costs, including healthcare, housing, and prescription drugs, which disproportionately affect older Americans living on fixed or semi-fixed incomes. While Social Security benefits are adjusted annually for inflation, many retirees rely on income streams that do not automatically keep pace with rising prices.

The deduction is intended to provide targeted relief without restructuring Social Security itself, which remains politically sensitive and financially complex.

A Political Compromise

Efforts to eliminate federal taxes on Social Security benefits entirely have repeatedly stalled due to concerns about lost revenue and long-term program funding. The New $6000 Senior Tax Deduction emerged as a compromise, offering tax relief without directly changing Social Security’s funding structure.

How the Deduction Works in Practice

Eligibility Requirements

To qualify for the deduction, taxpayers must:

- Be 65 years or older by December 31 of the tax year

- File a federal income tax return

- Meet income requirements for full or partial eligibility

There is no requirement that a taxpayer receive Social Security benefits to claim the deduction. Seniors who are still working or who rely primarily on other retirement income sources may also qualify.

Income Limits and Phase-Out Rules

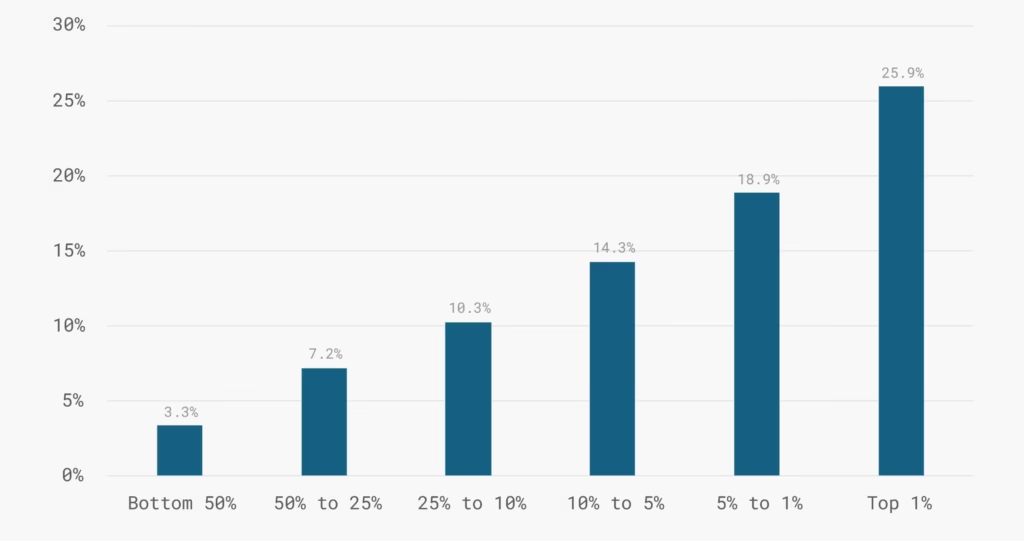

The deduction is not universal. It phases out gradually as income rises, reducing its value for higher-income seniors.

For single filers, the phase-out begins at a specified income threshold and increases incrementally. For married couples filing jointly, higher combined income limits apply. Once income exceeds the upper threshold, the deduction is eliminated entirely.

This structure ensures the largest benefits flow to low- and middle-income seniors, while limiting fiscal impact at the top end of the income scale.

Interaction With Social Security Income

What the Deduction Does Not Change

The New $6000 Senior Tax Deduction does not change how Social Security benefits are calculated or how much of those benefits may be subject to federal income tax.

Under existing law, up to 85% of Social Security benefits can be taxable depending on a taxpayer’s combined income, which includes adjusted gross income, non-taxable interest, and half of Social Security benefits.

Those rules remain fully intact.

What the Deduction Can Change

While it does not rewrite Social Security tax law, the deduction can reduce overall taxable income, which may lower the portion of Social Security benefits subject to tax for some retirees.

For example, a senior whose income sits near the threshold at which Social Security benefits become taxable may, after applying the deduction, fall below that threshold. In such cases, the deduction could effectively reduce or eliminate federal taxes on Social Security income without changing the formal tax rules.

Who Benefits the Most — and Who Does Not

Likely Beneficiaries

- Seniors with moderate retirement income from Social Security, pensions, or retirement accounts

- Married couples where both spouses qualify

- Retirees who still have some taxable income but are not in higher tax brackets

For these groups, the deduction may result in hundreds or even thousands of dollars in annual tax savings.

Limited or No Benefit Groups

- Seniors with very low income, who already owe little or no federal tax

- High-income retirees whose earnings exceed the phase-out thresholds

- Individuals relying entirely on non-taxable income

In these cases, the deduction may provide little practical benefit.

Temporary Relief and Policy Uncertainty

A Four-Year Window

The New $6000 Senior Tax Deduction is currently scheduled to apply only from 2025 through 2028. Without congressional action, it will expire automatically.

Temporary tax provisions create uncertainty for retirees attempting long-term financial planning. Advisors caution that seniors should not assume the deduction will exist beyond its current expiration date.

Budgetary and Fiscal Considerations

From a federal budget perspective, the deduction represents a measurable reduction in tax revenue. Supporters argue the cost is justified by the financial pressures facing older Americans, while critics warn that repeated temporary tax breaks complicate fiscal planning and may increase long-term deficits if extended without offsets.

Historical Context: How This Fits Into Senior Tax Policy

The United States has long used the tax code to provide targeted relief to older Americans, including:

- Higher standard deductions for seniors

- Preferential treatment of certain retirement income

- Partial exclusions for Social Security benefits

The New $6000 Senior Tax Deduction builds on this approach rather than replacing it, reinforcing the idea that retirement policy in the U.S. remains largely incremental rather than transformational.

Planning Considerations for Seniors

Filing Strategy

Tax professionals recommend that seniors:

- Review eligibility carefully

- Ensure age status is correctly recorded on tax returns

- Consider how retirement account withdrawals interact with the deduction

Because deductions reduce taxable income, timing withdrawals strategically may increase the deduction’s impact.

Role of Professional Advice

Financial planners emphasize that while the deduction can help, it should be considered as part of a broader retirement strategy that includes healthcare planning, required minimum distributions, and estate considerations.

FAQ

Does the New $6000 Senior Tax Deduction eliminate taxes on Social Security?

No. It may reduce taxable income, but existing Social Security tax rules remain unchanged.

Do seniors have to itemize to claim the deduction?

No. The deduction applies whether taxpayers take the standard deduction or itemize.

Is the deduction permanent?

No. It is scheduled to expire after the 2028 tax year unless extended.

Does employment income affect eligibility?

Yes. Wages and other income count toward the phase-out thresholds.