Tax changes usually arrive with a lot of noise from Congress, but some of the most impactful shifts happen quietly. That is exactly what is happening right now. New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, and many taxpayers may not realize how significant these changes could be.

While the core tax laws remain the same, updated guidance from the IRS is reshaping how benefits are interpreted, verified, and approved. What makes this situation especially important is that the changes affect everyday taxpayers. Families, gig workers, freelancers, and small business owners could all feel the impact. New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 not by removing credits or deductions, but by tightening rules, clarifying definitions, and requiring stronger documentation. If you rely on tax benefits each year, understanding what is coming could protect your refund and save you from future headaches.

The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 by redefining how eligibility is determined and how claims are reviewed. The IRS is focusing on accuracy, consistency, and data verification. That means fewer gray areas and less flexibility when it comes to reporting income, claiming dependents, or qualifying for credits. For years, many tax benefits have been claimed based on self-reported information with limited cross-checking. That approach is changing. The IRS now has access to more third-party data than ever before, and the new guidance is designed to align tax benefit rules with that data. For taxpayers who file correctly, this shift can bring clarity. For those who rely on estimates or incomplete records, it could bring challenges.

Table of Contents

New IRS Guidance Could Change How Millions Claim Tax Benefits in 2026

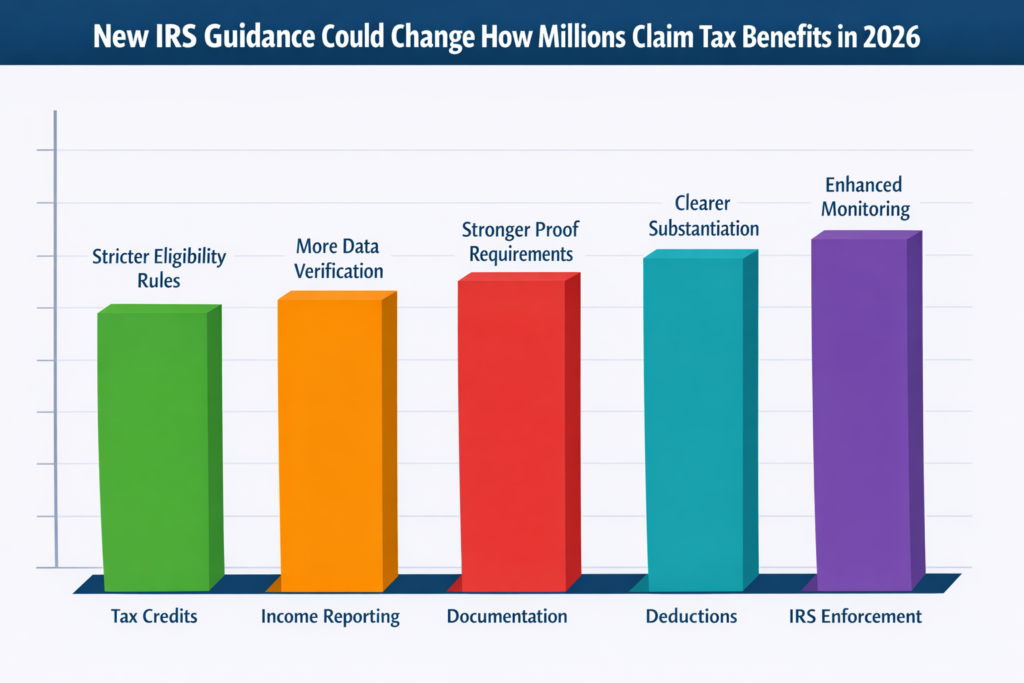

| Area Impacted | What Is Changing | Who Is Affected | Potential Outcome |

|---|---|---|---|

| Tax Credits | Stricter eligibility definitions | Families, low-income taxpayers | Refund adjustments |

| Income Reporting | Expanded third-party verification | Gig workers, freelancers | Fewer mismatches |

| Documentation | Higher proof requirements | All taxpayers | Reduced errors |

| Deductions | Clearer substantiation rules | Self-employed individuals | Better compliance |

| IRS Reviews | Faster data-based checks | High-risk filings | Quicker resolutions |

Why The IRS Is Issuing New Guidance

The IRS has been under increasing pressure to reduce improper payments and improve trust in the tax system. Studies have consistently shown that a large portion of tax benefit errors come from misunderstanding the rules rather than intentional misuse. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 as part of a broader effort to address that issue. Another major factor is modernization. Over the past few years, the IRS has invested heavily in technology. It now receives more detailed income reports from employers, financial institutions, and online payment platforms. With that information, it can quickly identify inconsistencies. Updated guidance ensures that taxpayers and the IRS are operating under the same clear standards.

Tax Credits Most Likely To Be Affected

- Tax credits are often the most valuable part of a tax return, especially refundable credits that can increase refunds even if no tax is owed. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 by refining how these credits are calculated and who qualifies.

- Credits tied to income levels will likely see closer scrutiny. Small differences in reported earnings could determine eligibility. Family-related credits may also require more detailed proof of residency, support, and dependency status. While eligible taxpayers will still be able to claim these benefits, the margin for error will be smaller.

Changes In Income Reporting And Verification

- Income reporting is one of the biggest areas of focus in the new guidance. The IRS plans to rely more heavily on data reported by third parties. Under the New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, income discrepancies may be flagged automatically.

- This is particularly important for people with multiple income streams. Gig workers, independent contractors, and online sellers often receive income from several platforms. If reported income does not match IRS records, tax benefits tied to income thresholds could be delayed or denied. Accurate recordkeeping will become essential.

What This Means For Deductions And Small Businesses

- Deductions are not being eliminated, but the rules around them are becoming clearer. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 by standardizing what qualifies as acceptable documentation.

- Self-employed taxpayers and small business owners may need to keep better records for expenses such as travel, home office use, and equipment purchases. While this may feel burdensome, it also reduces uncertainty. Clear rules help compliant taxpayers avoid disputes and audits.

Increased Focus on Documentation and Proof

- One consistent theme in the new guidance is documentation. The IRS wants stronger proof that taxpayers meet eligibility requirements. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026 by requiring records that clearly support claims.

- This does not mean every taxpayer will be audited. Instead, it means the IRS expects taxpayers to be able to back up claims if asked. Digital records, receipts, and income statements will play a larger role in future filings.

How Taxpayers Can Prepare Ahead Of Time

- Preparation is the best defense against future problems. Even though the changes apply to 2026 and beyond, taxpayers can start adjusting now. Organizing records, tracking income carefully, and understanding eligibility rules will make future filings smoother.

- The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, but proactive taxpayers can stay ahead by reviewing past returns and identifying areas that may require better documentation. Working with a tax professional can also help clarify how the guidance may apply to individual situations.

Common Mistakes Taxpayers Should Avoid

- One common mistake is assuming that familiar credits will work the same way forever. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, and relying on outdated assumptions could lead to errors.

- Another mistake is poor recordkeeping. Missing documents or inconsistent income reports can delay refunds or trigger reviews. As IRS systems become more automated, errors are more likely to be caught quickly.

The Long-Term Impact On The Tax System

- Looking beyond 2026, this guidance signals a shift toward a more data-driven tax system. The IRS is moving away from broad estimates and toward precise verification. The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, but it also sets the stage for a more transparent and predictable filing process.

- For most taxpayers, benefits are not disappearing. The process of claiming them is simply becoming more structured. Those who adapt early are likely to benefit from fewer disputes and faster processing.

What To Expect As 2026 Approaches

- As 2026 gets closer, additional clarifications are likely. The IRS often updates guidance as new issues arise. Staying informed will be key. Taxpayers who follow updates and adjust their filing habits will be better prepared.

- The New IRS Guidance Could Change How Millions Claim Tax Benefits In 2026, but it does not have to be disruptive. With preparation, accurate reporting, and clear documentation, taxpayers can continue to claim the benefits they qualify for with confidence.

FAQs on New IRS Guidance Could Change How Millions Claim Tax Benefits in 2026

Will tax benefits be reduced because of the new guidance?

Most benefits will remain the same. The main changes involve how eligibility is verified.

Who should pay the most attention to these changes?

Families claiming credits, gig workers, freelancers, and small business owners.

Does this guidance affect current tax returns?

No. It is aimed at future tax years, primarily starting in 2026.

Will audits increase because of this guidance?

Not necessarily. Improved data matching may reduce the need for audits by catching errors early.