A group of Democratic lawmakers has introduced legislation that would provide a $200 Monthly Boost in 2026 to millions of Americans receiving Social Security and related federal benefits, positioning the proposal as a short-term response to rising living costs that disproportionately affect older adults and people with disabilities.

The measure, formally titled the Social Security Emergency Inflation Relief Act, would authorize an additional $200 payment each month for six months beginning in January 2026. If enacted, the payments would be delivered automatically and would supplement, not replace, the annual cost-of-living adjustment (COLA) already scheduled for that year.

Supporters of the bill argue that recent inflation trends—particularly in housing, healthcare, and food—have eroded the purchasing power of fixed incomes, even as headline inflation has moderated. The proposal, however, faces fiscal scrutiny in a divided Congress concerned about long-term budget sustainability.

Table of Contents

New Social Security Bill

| Key Fact | Detail / Statistic |

|---|---|

| Primary Proposal | $200 extra per month for six months in 2026 |

| Duration | January–June 2026 |

| Programs Covered | Social Security, SSI, SSDI, veterans, railroad retirement |

| 2026 COLA | 2.8% increase already scheduled |

| Tax Status | Proposed as tax-free, non-countable income |

| Estimated Reach | Over 70 million beneficiaries |

What the Proposed Bill Would Do

Under the legislation, eligible beneficiaries would receive a flat $200 Monthly Boost in 2026 for each of the first six months of the year. The payments would be issued alongside regular benefit checks and would not require beneficiaries to apply or submit additional documentation.

Lawmakers sponsoring the bill describe the measure as a targeted inflation response rather than a permanent expansion of benefits. The intent, they say, is to bridge a gap between the standard COLA calculation and real-world expenses faced by seniors and disabled individuals.

According to congressional aides familiar with the bill’s drafting, the payments would be administered by the U.S. Department of the Treasury in coordination with the Social Security Administration, minimizing administrative complexity.

How It Fits with the 2026 COLA

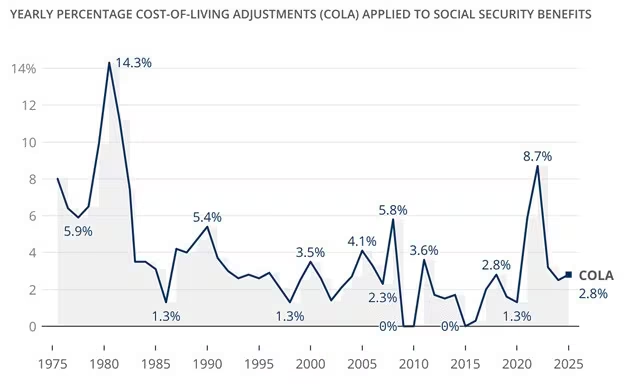

The Social Security Administration has already announced a 2.8% cost-of-living adjustment for 2026, reflecting inflation data measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For the average retired worker, that adjustment translates to roughly $56 more per month.

Advocates argue that while COLAs help preserve purchasing power over time, they often lag behind fast-moving price increases in essential categories such as rent, prescription drugs, and medical services. The $200 Monthly Boost in 2026, supporters say, would provide immediate relief without altering the COLA formula itself.

Who Would Benefit By New Social Security Bill

The proposal casts a wide net, extending eligibility beyond traditional retirees to include several categories of federal benefit recipients:

- Social Security retirement beneficiaries

- Social Security Disability Insurance (SSDI) recipients

- Supplemental Security Income (SSI) beneficiaries

- Railroad Retirement Board annuitants

- Veterans receiving disability compensation or pension benefits

Policy analysts note that these groups often face overlapping financial pressures, including higher healthcare costs and limited ability to supplement income through work. According to SSA data, nearly half of elderly beneficiaries rely on Social Security for at least 50% of their income, while roughly one-quarter depend on it for 90% or more.

Legislative Momentum and Challenges

The bill is backed by several high-profile Senate Democrats, including Sen. Elizabeth Warren of Massachusetts, Senate Majority Leader Chuck Schumer of New York, and Sen. Ron Wyden of Oregon, who have framed the proposal as an urgent but temporary intervention.

“This is about recognizing economic reality,” Warren said in a statement announcing the bill. “Seniors and people with disabilities are still paying higher prices for essentials, and Social Security should not fall behind.”

Republican lawmakers have not uniformly opposed the idea, but many have raised concerns about cost and precedent. Some fiscal conservatives argue that temporary supplements, while politically popular, could complicate broader negotiations over Social Security’s long-term financing.

The Congressional Budget Office has not yet released a formal cost estimate, but independent analysts suggest the six-month program could cost tens of billions of dollars, depending on final eligibility rules.

Expert Perspectives on Inflation and Benefits

Economists who study retirement security say the debate highlights a structural challenge in Social Security policy: the gap between official inflation measures and the lived experience of retirees.

“Older households spend disproportionately on healthcare and housing, which tend to rise faster than overall inflation,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “A temporary boost like this can help, but it doesn’t solve the underlying mismatch.”

Other experts caution that one-time payments may mask deeper issues, including the long-term solvency of the Social Security trust funds, which trustees project could face depletion in the mid-2030s without legislative changes.

Historical Context: How Temporary Boosts Have Been Used Before

Temporary benefit increases are not without precedent. During periods of economic stress, Congress has previously approved one-time or short-term payments to Social Security recipients, including stimulus checks during the COVID-19 pandemic.

However, those payments were typically broader in scope and tied to emergency economic relief packages. The $200 Monthly Boost in 2026 would be more narrowly targeted and explicitly linked to inflation concerns rather than economic contraction.

Policy historians note that such measures often gain traction during election cycles, when lawmakers face pressure to demonstrate responsiveness to cost-of-living concerns among older voters.

Fiscal Debate and Long-Term Implications

Beyond immediate relief, the proposal has reopened debate about how Social Security should adapt to evolving economic conditions. Critics argue that adding benefits without addressing revenue could accelerate trust-fund depletion.

Supporters counter that the bill is intentionally temporary and does not alter benefit formulas or eligibility rules. They argue that Congress can—and should—separate short-term relief from long-term reform discussions.

“This is not a rewrite of Social Security,” Wyden said during a Senate hearing. “It’s a stopgap measure to help people afford basics right now.”

Outlook for Beneficiaries

If the bill passes, eligible recipients could receive up to $1,200 total over six months, delivered automatically with their regular payments. The legislation specifies that the payments would be tax-free and would not count as income for purposes of determining eligibility for other federal assistance programs.

As of now, the proposal remains in committee and has not been scheduled for a full vote. Its fate will likely depend on broader budget negotiations and the political landscape heading into 2026.

For beneficiaries, the uncertainty underscores a familiar reality: while Social Security remains a cornerstone of retirement security, its future—and the adequacy of its benefits—continues to be shaped by political compromise.

FAQs About New Social Security Bill

Is the $200 Monthly Boost in 2026 guaranteed?

No. The boost is a proposal and must pass both chambers of Congress and be signed into law.

Would beneficiaries need to apply?

No. Payments would be automatic for eligible recipients.

Would the boost affect other benefits?

The bill specifies that the payments would not count as income for means-tested programs.

Is this a permanent increase?

No. The boost would last for six months only.