Some IRS Refunds May Be Delayed: Every year, millions of Americans eagerly anticipate their federal tax refunds, planning to use that extra cash to catch up on bills, build savings, or splurge a little. But for the 2026 tax season (covering 2025 income), many filers might have to wait longer than expected. That’s because the IRS has announced that some refunds may not arrive until early March, even if you file your taxes as soon as the season opens. If you’re wondering why this delay is happening, whether it affects you, and how to avoid extra waiting time, you’re in the right place. This article walks you through everything in a down-to-earth, plain-English way — with professional-grade insights built in.

Table of Contents

Some IRS Refunds May Be Delayed

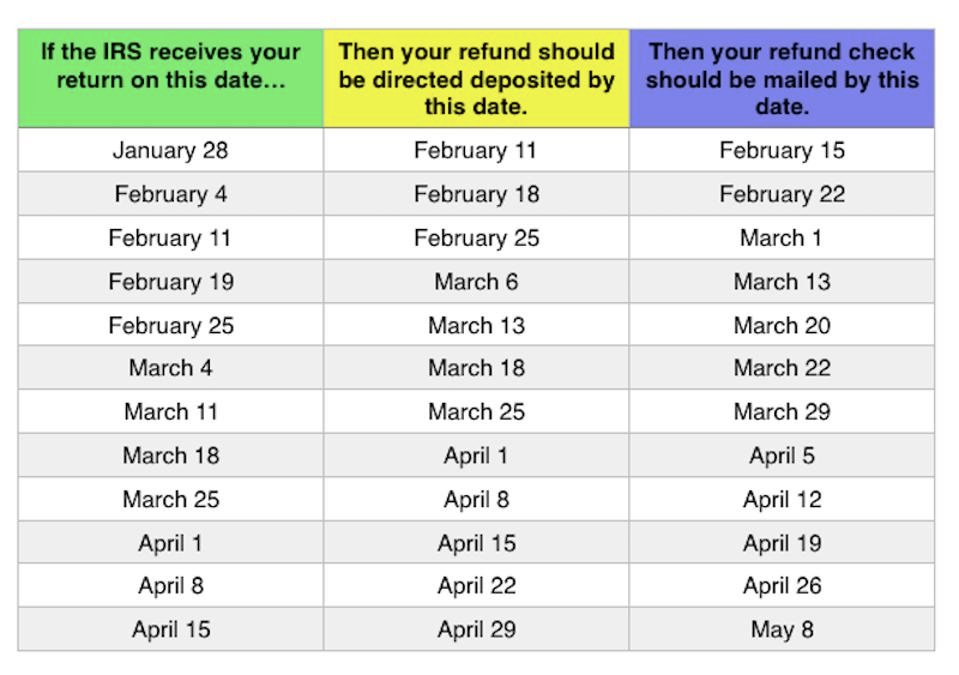

If you’re filing taxes in 2026 and claiming the EITC or ACTC, expect a longer wait than usual. While most refunds arrive within three weeks, yours may not land until early March — even if you file early and use direct deposit. This isn’t a mistake — it’s a federal safeguard under the PATH Act to reduce fraud and protect taxpayers like you. But you can still minimize other delays by filing accurately, using electronic systems, and monitoring your return. Knowing what to expect — and preparing for it — is the best way to avoid stress and set yourself up for a smoother tax season.

| Topic | Details |

|---|---|

| Refund Delay Date | Refunds for EITC/ACTC filers may be delayed until March 2, 2026 |

| Affected Filers | Those claiming Earned Income Tax Credit (EITC) and/or Additional Child Tax Credit (ACTC) |

| Reason for Delay | IRS compliance with the PATH Act, designed to prevent fraud |

| Normal Refund Window | Most refunds are issued within 21 days of filing (e-file + direct deposit) |

| Average Refund 2025 | $3,167, per IRS Filing Statistics |

| EITC Claim Stats | Over 25 million taxpayers claimed EITC last season |

| IRS Refund Tracker | Where’s My Refund Tool |

| More Resources | IRS.gov Newsroom |

Why Some IRS Refunds May Be Delayed Until March?

This isn’t a case of IRS systems crashing or budget cuts (although those exist too). The delay stems from a well-established law: the Protecting Americans from Tax Hikes (PATH) Act, passed in 2015.

This law requires the IRS to hold refunds for tax returns that claim:

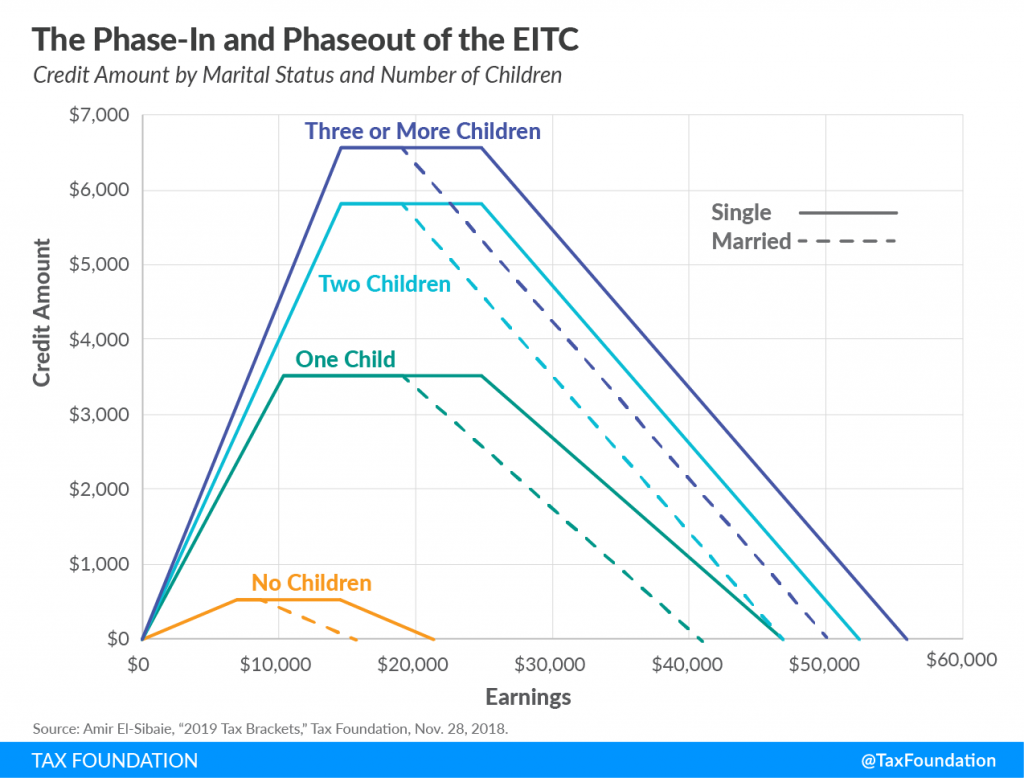

- The Earned Income Tax Credit (EITC)

- The Additional Child Tax Credit (ACTC)

until mid-February, even if the return is perfectly filed.

The goal is to give the IRS more time to verify W-2 income and dependent eligibility, preventing billions in fraudulent refunds. In past years, identity thieves filed fake returns early in the season and collected refunds before the IRS could cross-check employer data. The PATH Act essentially closed that loophole.

By law, even if your return is perfect and filed on January 29 (the first day of the 2026 tax season), the earliest the IRS can issue a refund with those credits is March 2.

This is not a delay based on processing time — it’s a mandatory waiting period for anti-fraud purposes.

Who’s Most Affected By Some IRS Refunds May Be Delayed?

1. Taxpayers Claiming EITC or ACTC

If you file a return and claim either of these two refundable tax credits, your refund will not be processed until after mid-February and likely not deposited until the first week of March.

These credits often apply to:

- Working families with children

- Single parents with lower income

- Workers without children (EITC eligibility expanded recently)

Why it matters:

These taxpayers typically depend on their refunds the most, making the delay feel more painful.

2. Filers With Errors or Identity Issues

Even if you don’t claim the EITC or ACTC, your refund could be delayed if:

- You made a typo on your Social Security Number or banking info

- Your income doesn’t match your W-2

- The IRS suspects identity theft and flags your return for manual review

These cases require manual intervention, which adds days — or weeks — to the process.

3. People Filing on Paper

Electronic filing is the fastest method, but some folks still mail paper returns. Those take much longer to process — 4 to 6 weeks minimum, sometimes more. And if a paper return includes the EITC or ACTC, it’s hit with a double whammy of delay.

What Is the PATH Act? A Quick Breakdown

Passed in 2015, the PATH Act introduced several tax reforms, but one of its main goals was to curb tax refund fraud by:

- Changing the earliest refund issue date for EITC/ACTC claims

- Requiring employers to file W-2s by Jan. 31 (instead of later)

- Giving the IRS time to verify earnings before issuing refunds

This legislation helps protect both honest taxpayers and government funds, but it can cause frustration if you’re not expecting it.

Common Scenarios: How It Might Affect You

Let’s look at two real-world examples:

Example 1: Maria the Single Mom

- Files on Jan. 29 using TurboTax

- Claims EITC and ACTC for her two kids

- Chooses direct deposit

- Refund status says “Accepted” on Feb. 1

- Refund issued on March 2, not earlier

Example 2: Jamal the Grad Student

- Files on Feb. 3

- Doesn’t claim any refundable credits

- Uses H&R Block e-file + direct deposit

- Refund issued by Feb. 15

So even though Maria filed earlier, her refund comes later — simply because she claimed credits that fall under the PATH Act’s delay rule.

How to Avoid Additional IRS Refunds May Be Delayed?

The PATH Act delay is unavoidable for some. But there are still several things you can do to avoid any additional setbacks:

1. File Electronically

Electronic returns are processed faster and more securely than paper returns. If you’re not already doing this, switch now.

2. Use Direct Deposit

Avoid checks in the mail. Direct deposit is not only faster, but safer. Make sure your bank routing and account numbers are accurate.

3. Check Your Return Carefully

Typos and errors are one of the top reasons for refund delays. Triple-check:

- Social Security Numbers

- Dependent names and ages

- Income entries from W-2s or 1099s

- Bank account info

4. Track Your Refund Status

Use the IRS “Where’s My Refund?” tool at irs.gov/refunds or the IRS2Go mobile app. These are updated daily and show:

- Return received

- Refund approved

- Refund sent

Don’t rely on third-party tax websites for refund tracking — the IRS tools are the only official source.

5. Sign Up for an Identity Protection PIN

If you’re concerned about identity theft (and who isn’t these days), you can enroll in the IRS Identity Protection PIN program. It adds a 6-digit PIN to your account, blocking anyone from filing a return in your name.

What About State Tax Refunds?

Your state refund might arrive earlier or later than your federal one — it depends on where you live. Most states don’t follow the PATH Act rules exactly, but they do have fraud checks in place.

Visit your state’s Department of Revenue website for timelines, refund trackers, and tax rules.

Tips for First-Time Filers

First tax season? Don’t stress — just keep it simple.

- Use IRS Free File if you make under $79,000/year

- File early, but know your refund may take time

- Don’t claim credits unless you qualify — EITC has strict income & family rules

- Avoid refund anticipation loans with big fees

Expert Advice from a Tax Pro

“One of the biggest misunderstandings I see each season is people thinking something is wrong with their return when it’s really just the PATH Act delay,” says Danielle Morris, EA and tax expert based in Minneapolis. “We tell our clients upfront — if you’re claiming the EITC or ACTC, don’t expect money before March.”

The best advice: File early, double-check everything, and be patient. Don’t let scammers take advantage of your anxiety by promising faster refunds in exchange for fees.

New IRS Guidance Could Change How Millions Claim Tax Benefits in 2026 – Check Details

Why Tax Experts Expect 2026 to Be One of the Biggest IRS Refund Years Yet

Who Qualifies for the First U.S. Program Offering $500 Guaranteed Monthly Income?