The maximum monthly retirement payment available under the $5181 Social Security Benefit in 2026 is attracting attention as Americans assess their long-term financial plans. According to the Social Security Administration (SSA), the figure represents the highest possible retirement benefit for individuals who meet strict lifetime earnings and age requirements. Only a small share of retirees qualify.

Reaching that maximum requires earning at or above the annual taxable limit for at least 35 years and delaying benefits until age 70. Financial experts caution that while the number is real, the path to achieving it is narrow and highly structured by federal law.

Table of Contents

$5181 Social Security Benefit in 2026

| Key Fact | Detail |

|---|---|

| Maximum monthly benefit at age 70 | $5,181 |

| Full Retirement Age (FRA) benefit | Approximately $4,152 |

| Early claim at age 62 | Roughly $2,969 |

| Earnings years counted | 35 highest-earning years |

| Delayed retirement credit | ~8% increase per year after FRA |

How the $5181 Social Security Benefit in 2026 Is Calculated

The SSA calculates retirement benefits using a worker’s Average Indexed Monthly Earnings (AIME). This figure reflects the 35 highest-earning years of a worker’s career, adjusted for national wage growth.

If a worker has fewer than 35 years of earnings, the SSA includes zero-income years in the calculation. That lowers the overall average and reduces the final benefit.

To qualify for the maximum payout, a worker must consistently earn at or above the annual taxable maximum for Social Security taxes. That ceiling increases each year based on wage growth nationwide.

After calculating AIME, the SSA applies a formula with “bend points,” which are income thresholds that determine how much of a worker’s earnings are replaced. The formula is progressive, meaning lower-income workers receive a higher percentage replacement rate than high earners.

As a result, the system provides proportionally greater support to middle- and lower-income retirees. Even those earning at the taxable maximum will not receive 100% of their prior wages.

Why Delaying Until Age 70 Matters

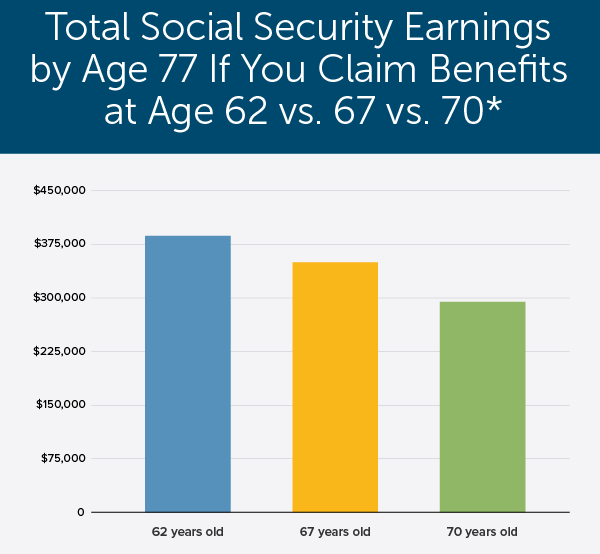

Age significantly affects the final benefit amount. Americans may begin claiming retirement benefits at age 62, but early filing results in a permanent reduction.

For individuals reaching retirement in 2026, the Full Retirement Age (FRA) is generally 67. Claiming at FRA provides 100% of the calculated benefit.

Delaying beyond FRA increases payments through delayed retirement credits. These credits add roughly 8% per year until age 70. There is no additional increase after age 70.

According to researchers at the Center for Retirement Research at Boston College, the difference between claiming at 62 and waiting until 70 can exceed $2,000 per month for high earners. Over a 20-year retirement, that gap may total hundreds of thousands of dollars.

However, experts stress that longevity assumptions matter. Delaying benefits may not be advantageous for individuals with shorter life expectancies or immediate income needs.

Cost-of-Living Adjustments and Inflation Protection

Another important factor behind the $5181 Social Security Benefit in 2026 is the annual cost-of-living adjustment (COLA). Each year, the SSA adjusts benefits based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

COLAs protect retirees from losing purchasing power due to inflation. The adjustment compounds over time, meaning a higher starting benefit also results in larger inflation-based increases in later years.

For retirees who wait until 70, delayed retirement credits increase the base benefit before COLA adjustments are applied. That structure magnifies long-term gains.

Earnings Test and Working While Claiming

Workers who claim benefits before FRA and continue working may face temporary benefit reductions under the earnings test. If earnings exceed an annual limit, the SSA withholds a portion of benefits.

Once a worker reaches FRA, the agency recalculates benefits to credit back withheld months. According to SSA guidance, the earnings test does not permanently reduce lifetime benefits.

Still, financial planners recommend careful timing. Workers who plan to take by yourself the strategy of delaying benefits while maintaining employment should understand how earned income interacts with Social Security rules.

Spousal and Survivor Benefits

While the $5181 Social Security Benefit in 2026 applies to individual retirement benefits, married couples may also qualify for spousal or survivor benefits.

Spouses can receive up to 50% of a worker’s benefit at FRA, depending on their own earnings record. Survivor benefits may equal up to 100% of the deceased worker’s benefit.

Delaying benefits can therefore increase household-level retirement income, particularly for couples where one spouse has significantly higher lifetime earnings.

Tax Implications of High Benefits

Retirees receiving higher Social Security payments may also face federal income taxes on a portion of their benefits.

Under current law, up to 85% of Social Security benefits may be taxable depending on total income. The Internal Revenue Service (IRS) calculates taxable amounts based on combined income thresholds.

High-income retirees who qualify for the maximum benefit often have additional retirement savings, pensions, or investment income. Financial advisors recommend coordinated planning to manage tax exposure.

Who Is Most Likely to Qualify?

SSA data show that only a small percentage of retirees reach the maximum benefit each year. Those individuals typically:

- Earned at or above the taxable maximum for at least 35 years

- Worked consistently without significant employment gaps

- Delayed claiming until age 70

- Lived long enough to benefit from delayed credits

Part-time workers, individuals with career breaks, and those with lower lifetime earnings generally receive smaller payments.

According to the Congressional Budget Office (CBO), most retirees receive benefits significantly below the maximum. The average monthly retirement benefit remains far lower than $5,181.

The Broader Financial Planning Context

Social Security was designed to replace only a portion of pre-retirement income. According to the Congressional Research Service (CRS), the program replaces roughly 40% of average earnings for middle-income workers.

That means even retirees who qualify for the $5181 Social Security Benefit in 2026 often rely on employer-sponsored retirement accounts such as 401(k) plans, individual retirement accounts (IRAs), and personal savings.

Financial planners emphasize diversification of retirement income sources. Social Security provides guaranteed, inflation-adjusted income backed by the federal government. Private savings offer flexibility and additional growth potential.

Future Outlook for Social Security

The long-term solvency of Social Security remains a subject of national debate. According to annual trustees’ reports, the program’s trust fund reserves are projected to face depletion within the next decade unless Congress enacts reforms.

If reserves were exhausted, payroll taxes would still fund a substantial portion of benefits. However, payments could be reduced without legislative action.

Policy proposals under discussion include raising the taxable wage cap, adjusting benefit formulas, increasing payroll tax rates, or modifying retirement ages. None have yet been enacted.

Experts say workers planning decades ahead should monitor legislative developments but base current retirement strategies on existing law.

What Comes Next

The SSA typically announces annual COLA adjustments each October. Those changes may affect benefit amounts for 2027 and beyond.

Workers approaching retirement are encouraged to review their earnings history through the “my Social Security” portal to ensure accuracy. Errors in reported income can affect benefit calculations.

For most Americans, the decision to delay or claim early remains highly individual. Health status, savings levels, marital status, and employment prospects all shape the optimal strategy.

The $5181 Social Security Benefit in 2026 represents the ceiling under current law. Qualifying requires decades of high earnings and patience. For many retirees, the more important question is not the maximum possible benefit, but the benefit that best fits their personal financial plan.

FAQ

Is the $5181 Social Security Benefit in 2026 guaranteed?

It is guaranteed under current law for individuals who meet all eligibility requirements and delay until age 70.

How many people receive the maximum benefit?

Only a small percentage of retirees qualify each year, according to SSA data.

Does working longer increase benefits?

Yes. Additional high-income years can replace lower-earning years in the 35-year formula.

Is delaying always the best option?

Not necessarily. Individuals with shorter life expectancy or urgent income needs may benefit from earlier claiming.