Tax refund season is always closely watched, but the filing year tied to 2026 is shaping up to be something out of the ordinary. Accountants, payroll specialists, and tax analysts are all pointing to the same conclusion: many Americans could see significantly larger IRS refunds when they file their 2025 tax returns. This expectation is not based on speculation or wishful thinking. It is rooted in concrete tax law changes, withholding mismatches, and expanded credits that together create a rare alignment favoring taxpayers.

For millions of households, the size of a tax refund can affect savings plans, debt repayment, and major purchases. Understanding why 2026 stands out helps taxpayers prepare, avoid surprises, and make smarter financial decisions. The reasons behind these expected refunds are technical, but their impact will be felt in very practical ways.

Tax experts expect 2026 to deliver unusually large IRS refunds because tax policy changes lowered overall tax liability faster than payroll systems could adjust. Throughout 2025, many workers continued having taxes withheld at higher rates that did not fully reflect new deductions, credits, and permanent tax cuts. When those same workers file their returns in early 2026, the IRS will reconcile what was paid versus what was actually owed, resulting in sizable refunds for a wide range of filers.

This situation is not about people suddenly earning less or claiming aggressive deductions. Instead, it is the result of structural changes in the tax code combined with delayed updates to withholding tables. That gap is the key reason refunds are expected to surge.

Table of Contents

Overview of Factors Driving Larger 2026 IRS Refunds

| Key Factor | What Changed | Impact on Refunds |

|---|---|---|

| Permanent tax cuts | Lower tax rates locked in | Reduces total tax owed |

| Higher standard deduction | Increased deduction thresholds | Shrinks taxable income |

| Expanded deductions | New write-offs for specific income | Lowers final tax bill |

| Withholding lag | Payroll systems slow to update | More tax overpaid |

| Expanded credits | Larger refundable credits | Directly increases refunds |

| SALT deduction cap increase | Higher deductible limit | Benefits high-tax states |

New Tax Law Changes Reduced Tax Bills

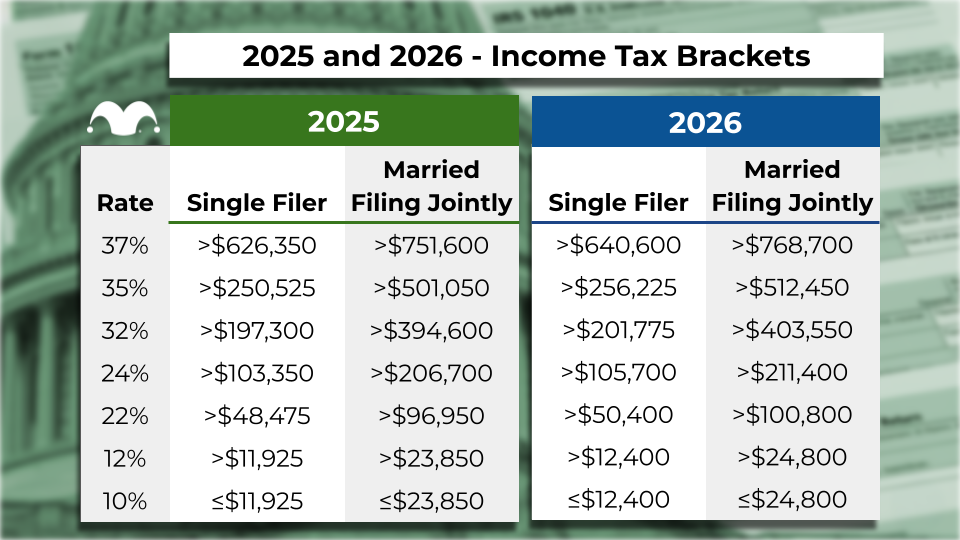

One of the most important drivers of higher refunds is the set of tax law changes that took effect during 2025. These changes permanently extended several tax cuts that were originally set to expire. Instead of facing higher rates, taxpayers continued to benefit from lower brackets that reduce how much income is taxed at higher levels.

At the same time, the standard deduction was increased. For many households, especially those that do not itemize deductions, this single change significantly reduced taxable income. When less income is subject to tax, the total amount owed at the end of the year drops accordingly.

In addition, lawmakers expanded or introduced deductions targeting specific types of income and expenses. These included deductions related to overtime pay, tip income, certain vehicle loan interest, and additional deductions aimed at seniors. Each of these provisions chipped away at taxable income in different ways, benefiting workers across multiple income levels.

Payroll Withholding Failed to Keep Pace

While tax liabilities dropped, payroll withholding did not immediately follow. This delay is a major reason refunds are expected to be unusually high.

Employers rely on IRS withholding tables to calculate how much tax to take out of each paycheck. When tax laws change mid-year or late in the year, those tables are often slow to update. As a result, many employees had taxes withheld as if the old rules were still fully in effect.

That meant workers paid more tax throughout 2025 than they actually owed under the updated law. The IRS does not automatically return that excess during the year. Instead, it is reconciled during tax filing season. When taxpayers submit their returns in 2026, that overpayment shows up as a refund.

For some households, this over-withholding could amount to hundreds or even thousands of dollars.

Average Refund Amounts Are Expected to Rise

Industry analysts and tax professionals expect average refund amounts to be noticeably higher than in recent years. While individual outcomes will vary, projections suggest refunds could increase by roughly $1,000 compared to prior filing seasons.

In some cases, average refunds may reach or exceed the $3,700 to $4,000 range. These figures reflect the combined effect of lower tax liability, higher deductions, and excess withholding being returned all at once.

It is important to note that a larger refund does not necessarily mean someone benefited more from the tax system overall. In many cases, it simply means they paid too much during the year and are getting their own money back.

Expanded Credits Play a Major Role

Refundable tax credits are another major contributor to the expected surge in refunds. Credits differ from deductions because they reduce tax owed dollar for dollar. If a credit exceeds the amount of tax owed, the remaining balance is refunded.

The expansion of the child tax credit is especially impactful. Families with qualifying children may see a direct boost to their refunds, even if their tax liability is already low. These credits are designed to provide direct financial relief and often make up a significant portion of a household’s refund.

For lower- and middle-income taxpayers, refundable credits can turn a modest refund into a substantial one.

Higher SALT Deduction Limits Help Certain Taxpayers

Another change influencing refund size is the increase in the state and local tax deduction cap. This adjustment primarily benefits taxpayers in states with higher income or property taxes.

By allowing more state and local taxes to be deducted from federal taxable income, the change reduces the federal tax bill for affected households. That reduction, combined with over-withholding, increases the likelihood of receiving a refund.

While this benefit is not universal, it plays a meaningful role for taxpayers in certain regions.

What This Means for Taxpayers Filing in 2026

For taxpayers, the expected refund surge presents both an opportunity and a caution. A larger refund can provide breathing room, help pay down debt, or support savings goals. However, it also signals that withholding may not be optimized.

Some taxpayers may prefer to adjust their withholding going forward so more money stays in their paycheck throughout the year rather than arriving as a lump sum refund. Others may welcome the forced savings effect of a refund.

Either approach is valid, but understanding why refunds are larger empowers taxpayers to make informed choices.

Final Thoughts

Tax experts expect 2026 to be one of the biggest IRS refund years yet because several forces are working together at the same time. Permanent tax cuts reduced liabilities, deductions and credits expanded benefits, and withholding systems failed to adjust quickly enough. The result is a widespread overpayment that will be returned during tax filing season.

For many Americans, the 2026 refund may feel unusually large. In reality, it reflects a system catching up to changes that were already in place. Knowing the reasons behind it helps taxpayers plan wisely, avoid confusion, and make the most of the money coming back to them.