Retirement doesn’t have to mean staying put. In fact, more Americans than ever are choosing to spend their retirement years overseas. Some are chasing a lower cost of living, others want better weather, and many are simply looking for a change of pace after decades of work. One of the biggest concerns people have before making that move is income.

Specifically, they wonder whether Social Security still pays if they no longer live in the United States. The answer surprises a lot of people. You Can Live Outside the U.S. and Still Collect Social Security, Here’s How, and for millions of retirees, this makes international living financially possible. You Can Live Outside the U.S. and Still Collect Social Security, Here’s How is not a loophole or a special exception, it’s a built-in part of how the system works. Social Security was designed to follow eligible beneficiaries, not tie them to a physical location. But while payments can continue abroad, there are rules that matter. Understanding them before you move can help you avoid interruptions, tax headaches, or unexpected suspensions later on.

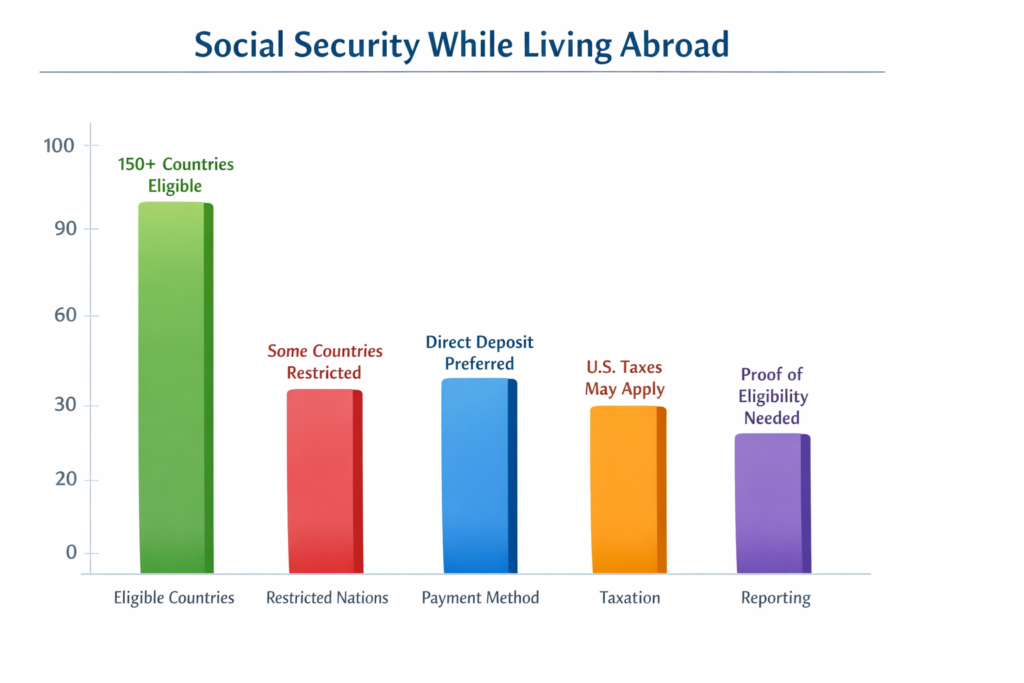

Living abroad does not automatically stop your Social Security benefits. In fact, the Social Security Administration sends payments to beneficiaries in over 150 countries every month. The key is eligibility and location. As long as you qualify for benefits and live in a country where payments are allowed, your monthly check can keep coming just as it would if you lived in the U.S. This flexibility is one of the reasons retiring overseas has become more realistic for middle income Americans. With proper planning, you can enjoy life abroad without sacrificing the income you worked decades to earn.

Table of Contents

You Can Live Outside the U.S. and Still Collect Social Security

| Category | Key Information |

|---|---|

| Eligibility | Most U.S. citizens qualify |

| Countries Covered | Payments allowed in 150+ countries |

| Restricted Locations | Benefits paused in certain countries |

| Payment Options | Direct deposit or limited check payments |

| Tax Considerations | U.S. taxes may still apply |

| Reporting Rules | Periodic eligibility confirmation required |

You Can Live Outside the U.S. and Still Collect Social Security Here’s How is not just a reassuring idea, it’s a proven reality for millions of retirees. With careful planning, clear communication, and a solid understanding of the rules, living abroad can be both financially stable and personally rewarding. Social Security does not limit where you live, it supports the lifestyle you choose, as long as you prepare wisely.

Who Can Receive Social Security Payments Abroad

- Most U.S. citizens who qualify for retirement or disability benefits can continue receiving payments while living overseas. Your work credits, earnings record, and benefit amount do not change simply because you move to another country. As long as you remain eligible, the location alone does not cancel your benefits.

- Some non-U.S. citizens can also receive Social Security abroad, depending on their immigration status, work history, and the country they live in. Survivors and dependents may qualify as well, although additional rules can apply in those cases. Because eligibility rules vary, it’s wise to confirm your specific situation before relocating.

Countries Where Social Security Is Paid

- The United States allows Social Security payments in most parts of the world. Popular retirement destinations such as Canada, Mexico, Portugal, Spain, Italy, and many Asian countries are approved. However, there are a handful of countries where payments are restricted due to U.S. law.

- If you move to one of these restricted countries, your benefits are suspended for the time you remain there. Once you move to an approved country, payments usually resume. This makes destination planning one of the most important steps when considering retirement abroad.

How Payments Are Delivered Overseas

For most retirees living abroad, direct deposit is the easiest and safest way to receive Social Security. Payments can be deposited into a U.S. bank account or, in many countries, directly into a local bank. This option minimizes delays and eliminates the risk of lost checks. Paper checks still exist but are becoming less common and can be unreliable depending on the country’s postal system. Setting up direct deposit before leaving the U.S. is one of the simplest ways to avoid payment issues later.

Reporting And Verification Requirements

When you live outside the United States, the Social Security Administration periodically needs to confirm that you are still eligible to receive benefits. This usually involves completing and returning a form that verifies your status. Failing to return this form on time can result in suspended payments. The good news is that payments typically resume once the form is received. Keeping your mailing address updated and responding promptly helps ensure your income continues without interruption.

Taxes On Social Security Benefits Abroad

- Moving overseas does not automatically eliminate your U.S. tax obligations. Depending on your total income, part of your Social Security benefits may still be subject to federal income tax. Whether you owe taxes depends on your combined income, not just your benefits alone.

- Some countries also tax Social Security income, while others do not. The United States has tax treaties with many countries to prevent double taxation, but the rules vary widely. Because of this complexity, many retirees choose to work with a tax professional who understands international income and retirement planning.

Medicare and Health Coverage Considerations

One of the biggest surprises for retirees abroad is Medicare. In most cases, Medicare does not cover healthcare outside the United States. This means that while your Social Security income follows you, your healthcare coverage usually does not. Many retirees address this by purchasing private international health insurance or using the local healthcare system in their new country. In many parts of the world, healthcare costs are significantly lower than in the U.S., making this more affordable than expected. Planning healthcare alongside your income is critical for a smooth transition.

What Happens If Payments Are Suspended

- Social Security payments can be suspended for several reasons, including living in a restricted country or failing to meet reporting requirements. While this can be stressful, it’s important to know that suspended payments are often temporary.

- Once the issue is resolved, payments typically resume. In some cases, you may receive back payments for months you were eligible but unpaid. Staying organized and proactive makes resolving these situations much easier.

Tips For Managing Social Security Abroad

Before leaving the U.S., notify the Social Security Administration of your move and provide updated contact information. Confirm that your destination country allows payments and set up direct deposit. Keep copies of important documents, including benefit letters and identification. Many retirees keep a U.S. bank account even while living abroad. This can simplify payments, taxes, and currency exchange. Small steps taken early can prevent big problems later.

FAQs on You Can Live Outside the U.S. and Still Collect Social Security

Can I receive Social Security if I live abroad permanently

Yes. Most U.S. citizens can receive Social Security while living abroad as long as they live in an approved country and remain eligible.

Are there countries where Social Security payments are not allowed

Yes. A small number of countries are restricted. Payments usually resume if you move to an approved country.

Do I need a U.S. bank account to receive Social Security abroad

No. Many countries support direct deposit into local banks, but some retirees prefer keeping a U.S. account for convenience.

Will my Social Security benefits be taxed if I live overseas

Possibly. U.S. federal taxes may still apply depending on your income, and local taxes depend on the country and tax treaties.